Banking has changed so much in the last few years that those who still do banking the way it was done many years ago are missing out. This article highlights four banking products that can make your banking experience fun, convenient and simple.

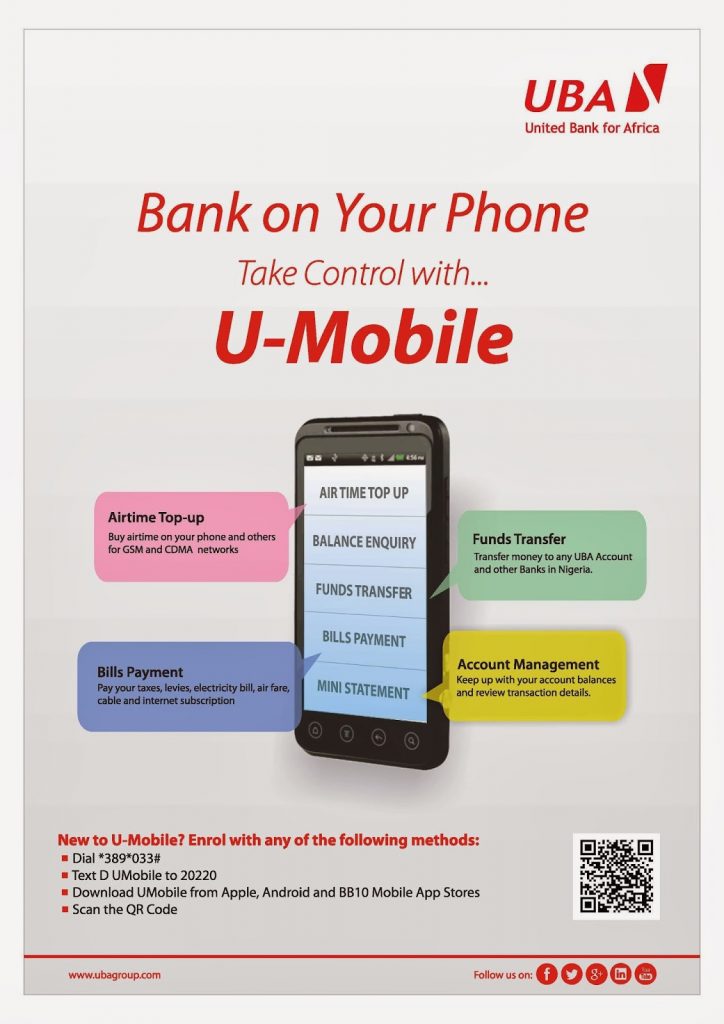

U-Mobile

U-Mobile is a great product from the e-banking

platform of United Bank for Africa Plc (UBA). With U-Mobile, the average UBA

customer can do almost 90 percent of his or her routine banking transactions on

the phone. It is an e-banking solution provided by UBA that allows customers to

access their account information via their GSM mobile phone.

platform of United Bank for Africa Plc (UBA). With U-Mobile, the average UBA

customer can do almost 90 percent of his or her routine banking transactions on

the phone. It is an e-banking solution provided by UBA that allows customers to

access their account information via their GSM mobile phone.

It also enables subscribers’ carryout basic

banking services anywhere in the country.

With U-Mobile, UBA customers can view their account statement, initiate

inter-account funds transfer, make payments to other bank accounts and individuals,

request for cheque books or stop cheques, download mini statements, make

utility bill payments, buy air-time, flight tickets, among others.

banking services anywhere in the country.

With U-Mobile, UBA customers can view their account statement, initiate

inter-account funds transfer, make payments to other bank accounts and individuals,

request for cheque books or stop cheques, download mini statements, make

utility bill payments, buy air-time, flight tickets, among others.

U-Mobile is unique in that users do not need

to have internet connectivity to initiate transactions on it. It is basically a bank on your phone offering

maximum convenience to the average bank customer.

to have internet connectivity to initiate transactions on it. It is basically a bank on your phone offering

maximum convenience to the average bank customer.

U-Direct

U-Direct is an

internet banking platform that allows UBA account holders access their account

(Savings and Current) from the comfort of their homes or offices on their

personal computers, laptops and tablet anytime, anywhere. With U-Direct, UBA customers can now take

charge of their banking transactions without having to visit the bank

physically.

internet banking platform that allows UBA account holders access their account

(Savings and Current) from the comfort of their homes or offices on their

personal computers, laptops and tablet anytime, anywhere. With U-Direct, UBA customers can now take

charge of their banking transactions without having to visit the bank

physically.

U-Direct allows customers to view all of their

personal or corporate accounts with UBA on their personal computers, laptop or

tablets. They can also view any loans they have running with the bank and

initiate payments.

personal or corporate accounts with UBA on their personal computers, laptop or

tablets. They can also view any loans they have running with the bank and

initiate payments.

U-Direct provides a

secure platform for interacting with the bank. Customers are able to initiate

and complete different transactions on U-Direct. These include; payment for

services and bills, transfer of funds from one account to another, make balance

enquiries, print statement of accounts

in excel file, access transaction history among others. With U-Direct, the

customer is saved the cost and time of having to visit his nearest bank branch.

secure platform for interacting with the bank. Customers are able to initiate

and complete different transactions on U-Direct. These include; payment for

services and bills, transfer of funds from one account to another, make balance

enquiries, print statement of accounts

in excel file, access transaction history among others. With U-Direct, the

customer is saved the cost and time of having to visit his nearest bank branch.

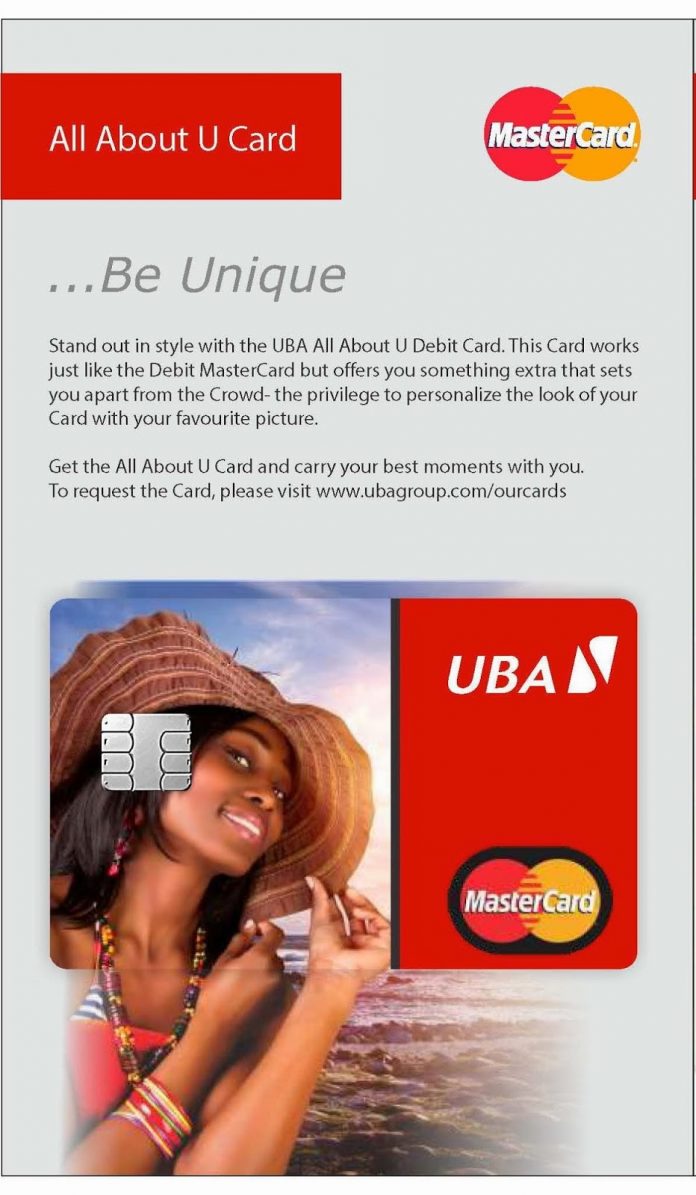

All-About-U-Card

This is a

“designer” card issued by UBA to its customers. It is for the fashionable and

trendy customer who is in love with branded or designer items.

“designer” card issued by UBA to its customers. It is for the fashionable and

trendy customer who is in love with branded or designer items.

The

All-About-U-Card, issued by UBA, allows customers to personally brand their

cards. Customers can chose to brand the cards with a personal picture, a

picture of loved ones or a preferred colour.

It is also perfect for corporate customers that may want to brand their

cards with the company’s logo and colours.

The cards are easy to obtain from any UBA Business Office across Africa.

All-About-U-Card, issued by UBA, allows customers to personally brand their

cards. Customers can chose to brand the cards with a personal picture, a

picture of loved ones or a preferred colour.

It is also perfect for corporate customers that may want to brand their

cards with the company’s logo and colours.

The cards are easy to obtain from any UBA Business Office across Africa.

Prepaid

Cards

Cards

There are many

reasons to have a UBA Prepaid card. Here are some.

reasons to have a UBA Prepaid card. Here are some.

UBA Prepaid Card

operates without the need to open a bank account. You can have a prepaid card

even if you do not have a bank account. It

is very easy and straight forward to obtain. Loading funds on a

UBA prepaid card is easy. This can be done at any UBA Business Office, Online

through U-Direct and UBA’s mobile banking platform, U-Mobile.

operates without the need to open a bank account. You can have a prepaid card

even if you do not have a bank account. It

is very easy and straight forward to obtain. Loading funds on a

UBA prepaid card is easy. This can be done at any UBA Business Office, Online

through U-Direct and UBA’s mobile banking platform, U-Mobile.

UBA Prepaid card

works just like any regular debit or credit card anywhere in the world. It

provides international travelers access to $10,000 in PTA/BTA per quarter or

$40,000 per year. With a UBA Prepaid

card, you can control how much you want spend in advance. Just load on the

card, the exact amount you plan to spend. They are acceptable anywhere in the

world, everywhere a Visa card is accepted globally. Cash pre-loaded on UBA

prepaid cards are accessible 24/7 over two million ATMs in the world, at over

30 million PoS and merchant points worldwide.

works just like any regular debit or credit card anywhere in the world. It

provides international travelers access to $10,000 in PTA/BTA per quarter or

$40,000 per year. With a UBA Prepaid

card, you can control how much you want spend in advance. Just load on the

card, the exact amount you plan to spend. They are acceptable anywhere in the

world, everywhere a Visa card is accepted globally. Cash pre-loaded on UBA

prepaid cards are accessible 24/7 over two million ATMs in the world, at over

30 million PoS and merchant points worldwide.

UBA Prepaid card is

the most secured card for online transactions as it is not tied to your bank

account. The implication is that fraudsters can never have access to your bank

account even if they steal the details of your UBA Prepaid card.

the most secured card for online transactions as it is not tied to your bank

account. The implication is that fraudsters can never have access to your bank

account even if they steal the details of your UBA Prepaid card.

UBA Prepaid card is

safer than cash. In the case of card theft, the fund remains intact and is

available to the cardholder upon card reissuance or replacement.

safer than cash. In the case of card theft, the fund remains intact and is

available to the cardholder upon card reissuance or replacement.

Hey, Wow all the posts are very informative for the people who visit this site.Good work!We also have a Blog.Please feel free to visit our site. Thank you for sharing.

fund perfect money with mastercard

Keep Posting:)

I am sure that information from https://homework-writer.com/blog/learn-algebra might be really useful for students and teachers. Especially if you need to learn algebra.