Nigeria

At the fifth Nigeria International Energy Summit (NIES 2022), Nigerian National Petroleum Corporation (NNPC), Shell, ENI and TotalEnergies signed a deal to deliver 70 million standard cubic feet of natural gas per day to Dangote Fertiliser Limited (DFL) to ramp up operations at the plant. It is aimed at increasing the local production of fertiliser in the country. The deal is estimated to save Nigeria approximately $1.8bn in FX.

The Central Bank of Nigeria (CBN) on Monday released guidelines for the operation of its recently initiated RT200 FX policy. According to the guidelines, transactions eligible for incentives under the scheme must be exports of finished and semi-finished goods wholly or partly processed or manufactured in Nigeria. Also, exporters will qualify for the rebates only where repatriated export proceeds are sold at the Investors’ and Exporters’ (I&E) Window. When the export proceeds are sold, the CBN would give the exporter ₦65 for every $1 sold.

Mali

UMOA-Titres, a West African debt agency stated that Mali has missed CFA46.3bn ($78.5mn) repayment for domestic debt as at February 2022. This is following sanctions imposed by the Economic Community of West African States (ECOWAS). § Furthermore, the agency stated that it is carefully monitoring the situation in order to ensure “optimal treatment of the maturities of the debt contracted by Mali”.

Cameroon

Cameroon expects to keep its public debt below 50% of its GDP in this current 2022 fiscal year. Cameroon intends to leverage its finance law to boost its non-oil revenues to 0.8% of GDP. In 2021, public debt was 44% of GDP, a 0.8% increase from 2022.

Uganda

According to a recent Consumer Price Index (CPI) publication by the National Institute of Statistics (NIS) of Uganda, the country’s annual urban CPI grew by 3.2% year-on-year in February 2022 vs 4.3% year-on-year in January 2022, indicating a 1.1ppts month-on-month decline.

The Ugandan Ministry of Finance recently reported that Uganda’s trade deficit narrowed down to $271.6mn in December 2021, from $329.9mn in December 2020, which signifies a 21.5% decline year-over-year, due to a decline in government imports for projects. For further context, Uganda’s trade deficit printed $278.7mn in November 2021, indicating a month-on-month decline of 2.5% in December 2021.

Kenya

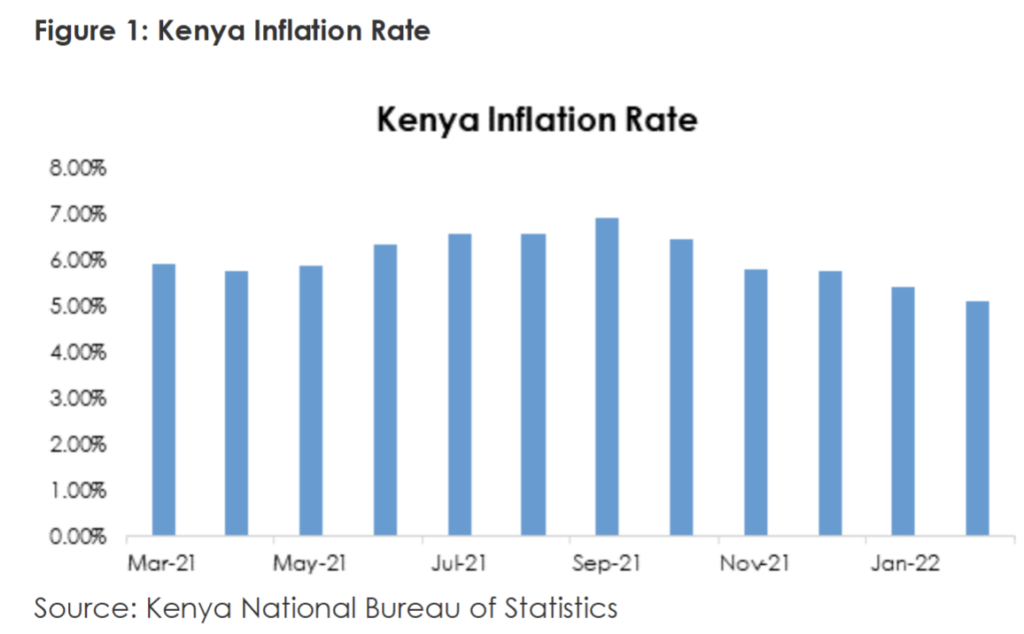

Kenya’s inflation fell to 5.08% in February from 5.39% in January due to lower food and electricity costs. This is the lowest level since October 2020 and is below the market expectation of 5.7%. Meanwhile, month-on-month, the country’s inflation rose to 0.40% in February from 0.31% in January. Kenya’s inflation has been declining since October 2021.

As inflation falls further in February, consumer’s real income and investor confidence is expected to improve. The prospect of higher consumer and investment spending is positive for the country’s growth and economic recovery.

Tanzania

The World Bank is projecting that Tanzania’s economy would grow between 4.5% to 5.5% this year from 4.3% in 2021 as activities recover from Covid-19 pandemic. The World Bank stated that Tanzania needs to accelerate its vaccine rollouts to quicken its economic recovery. The positive growth outlook of Tanzania would make the country more attractive to investors and businesses.

As the country expands, its productivity would increase and more jobs are expected to be created. It also puts the country on track to economic recovery to its pre-pandemic level (5.8%). The vaccination programme is crucial for a stable recovery of the travel & tourism sector, which accounts for more than 25% of the country’s forex earnings.

Angola

The Angolan government has approved its 2022 annual indebtedness plan. The Ministry of Finance estimates the government’s 2022 gross financing needs at Kz6.8trn ($10.7bn/13% of GDP), which is 28.92% above $8.3bn in 2021. Angola’s new annual indebtedness plan shows that the government’s financing needs are higher in 2022, which would be funded by domestic and foreign debt. The increased financing needs would be driven mainly by the high level of debt service considering that global interest rates are already increasing. Higher debt service cost and borrowing is negative for the country’s fiscal coffers. However, oil prices are now above $100 per barrel (pb), which is positive for Angola’s fiscal and external position.

Higher oil revenue would in turn reduce the country’s deficit financing needs and support the country’s economic recovery process. The Economist Intelligence Unit (EIU) projects that Angola would grow by 2.5% in 2022 following six years of recession.

Read Also: Business Trends, Industry Insights and Policy Changes – Vol 3

Zambia

Zambia’s Central African Renewable Energy Corp has started a project to process tyres and plastic wastes in order to produce fuel. The company currently processes 1.5 tonnes of waste to make 600-700 litres of diesel and gasoline per day on a pilot basis. The country consumes about 140 million litres of petrol per day. Processing plastic wastes and tyres to fuel would boost Zambia’s fuel supply and reduce its oil import bill.

The country spends approximately $1.4bn annually on fuel imports. It also provides Zambia with the opportunity to export fuel to other countries, which is positive for export earnings, external reserves and exchange rate stability. In addition, it would help clean up Zambia’s environment by reducing waste and converting it into energy.

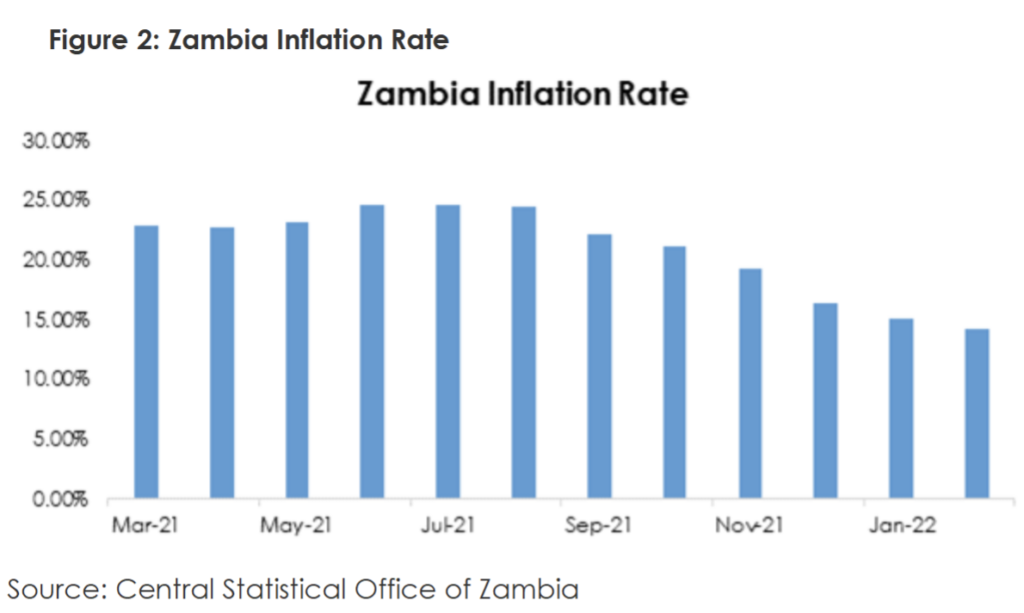

Zambia’s Consumer Price Index(CPI) rose to 14.2% year-on-year in February 2022, down from 15.1% year-on-year in January 2022. The Bank of Zambia has adjusted its forecast to average 13.2% in 2022, down from its 15.0% projection in its November 2021 Monetary Policy Committee (MPC) meeting. Food inflation slowed to 16.0% year-on-year in February 2022 from 16.9% year-on-year in January 2022, and core inflation slowed to 11.8% year-on-year in February 2022 from 12.7% year-on-year in January 2022.

Rwanda

According to the Rwandan Statistics Agency, Rwanda’s producer inflation rate accelerated from 7.8% year-on-year in December 2021 to 8.0% year-on-year in January 2022, up by 20 basis points (bps) month-on-month.

According to the Kigali-based statistics agency, Rwanda’s trade deficit narrowed to $211.2mn in January 2022, from $218.3mn recorded in December 2021, as imports and exports recorded a 10% year-on-year and 17.3% year-on-year decline to settle at $348.4mn and $137.3mn vs $387.1mn and $166.1mn recorded in December 2021, respectively.