Nigeria

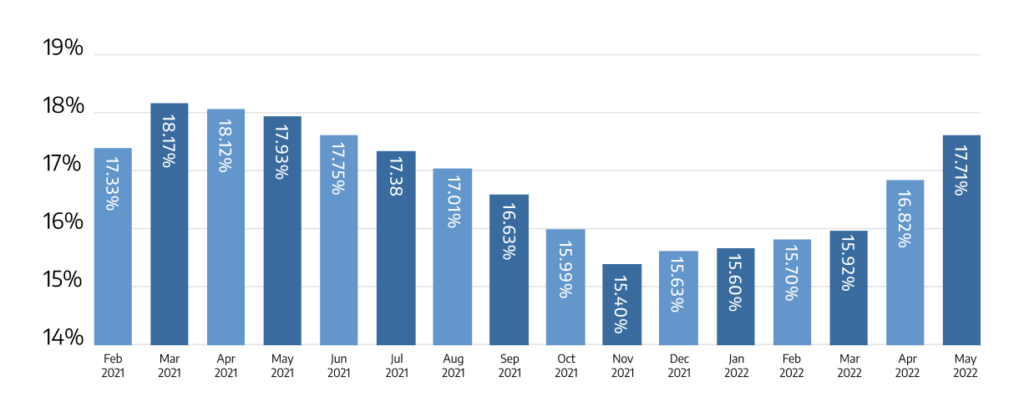

The National Bureau of Statistics (NBS) published the Consumer Price Index (CPI) report for May 2022. According to the index, headline inflation rose 529bps to 17.7%, an 11-month high. Food inflation soared by 2.01% month-on-month (MoM) in May, 1bp higher than April’s figure. The country’s persistent increase in inflation represents a continuous decrease in consumer purchasing power and, as a result, a lower standard of living for citizens.

Figure 1: Nigeria Inflation Rate

Ghana

The Development Bank of Ghana aims to disburse c. $800 million in capital. It aims to increase lending to small and medium-sized businesses (SMBs) by 5 times to help abate funding challenges.

The Bank of Ghana recently released a report revealing, that the nation’s interest payments hit GH¢10.6 billion in Q1-2022 with foreign payments accounting for 17.3%.

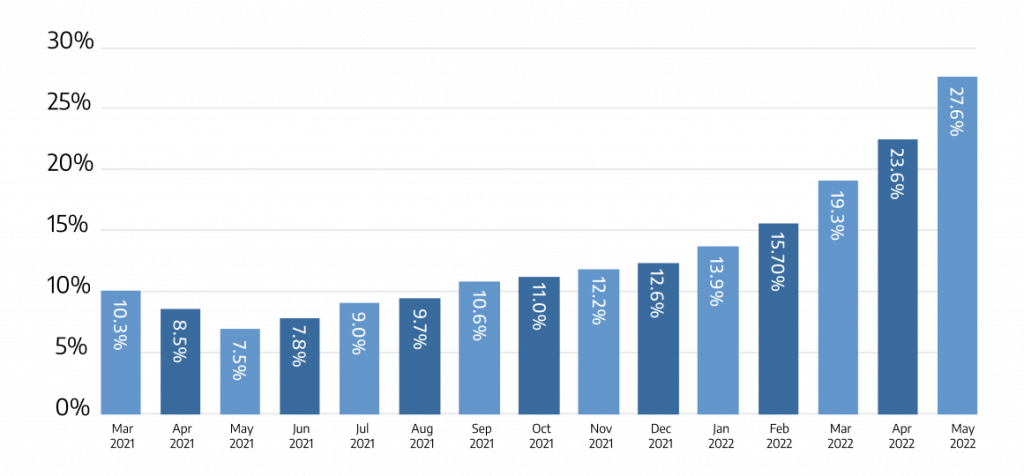

The Ghana Statistical Service revealed the Nation’s inflation numbers jumped to 27.6%y/y in May from 23.6% in April.

Ghana

The Central Bank of Ghana hiked its benchmark interest rate by 200bps to 19% to curb inflationary pressures and promote its macroeconomic stability following April’s consumer inflation rate.

Ghana’s inflation rate climbed to the highest level in more than 18 years in April at 23.6%, from 19.4% in March. Headline inflation is now more than twice the top of the Central Bank’s target band of 6% to 10% and has been above the range for eight months. The persistent increase in the inflation level of the country represents a continuous decrease in the purchasing power of consumers and therefore a lower standard of living for citizens. Poverty index is at risk of increasing and the economic growth of the country is also affected. The increase in transportation and food prices can also lead to social unrest due to an increase in hardship level.

Ivory Coast

According to Bloomberg, Ivorian farmers shipped 31,112 tonnes of cocoa to ports last week. Cocoa grind exports increased by 65.6% y/y at the end of Q1-2022, reaching 417,000 tonnes.

Kenya

| Haron Sirima, the Head of the Public Debt Management Office, revealed on 13 June 2022 that Kenya plans to borrow $1.0 billion from banks by the end of the month. This follows the Treasury’s decision to postpone the issuance of a Eurobond. The syndicated loan plan is intended to help close the country’s Ksh1.02 trillion ($8.7 billion) budget deficit. Ukur Yatani, Kenya’s Treasury Secretary, announced plans to phase out fuel subsidies in the next fiscal year, which begins next month, July 2022. It comes as petrol prices have risen for the fourth month in a row and are unlikely to recover to levels experienced prior to the Russian war. The regulator reported a 6.0% increase in the retail price of petrol in Nairobi. |

Tanzania

The government and companies, including Equinor ASA, ExxonMobil and Shell Plc, have signed initial agreements toward the development of a $40 billion liquefied natural gas project. This signing precedes a Host Government Agreement (HGA) which is expected to be signed by year-end, according to President Samia Suluhu Hassan. Developing the liquefied natural gas project could begin in 2025, 3 years after a final investment decision is made. It comes after a decade of prolonged negotiations

| Tanzania increased its 2022/2023 National budget by 9.0% to TSh41.8 trillion for the financial year starting July 2022. The budget anticipates TSh28.02 trillion in domestic revenue, 67.5% of the overall budget. Tanzania plans to borrow TSh5.78 trillion from domestic markets and TSh3.03 trillion from non-concessional sources. |

| The United States Department of Agriculture (USDA) report projects Tanzania’s 2022/2023 coffee crop production to decrease by 4.0% y/y to 1.15 million bags due to high fertilizer prices and drought conditions in Q1-2022. Exports are expected to fall at the same rate to 1.05 million bags, each weighing 60kg (132lb). |

Uganda

According to 2022/2023 budget documents, the nation’s financing gap will narrow by 260bps from 7.3% to 5.4% of GDP. It expects to collect Ush30.8 trillion in domestic revenue. Domestic and external financing will amount to Ush5.01 trillion and Ush6.72 trillion respectively. Total expenditure will be Ush48.1 trillion, 7.4% greater than the initially budgeted USh44.8 trillion.

The nation’s largest gold discovery is now at its development stage. The Wagagai Gold Project in Busia, close to the Kenyan border, holds an estimated 12.9MT of ore as disclosed by Uganda’s Ministry of Energy and Mineral Development. Its gold ore is at 2.89g/t grade.

This is in addition to earlier discoveries by the government of 103.0MT of iron ore in the South-Western Kabale district, and 15.0MT in the neighbouring Rubanda district.

Mozambique

This is in addition to earlier discoveries by

| Mozambique’s Consumer Price Index (CPI) rose by 9.3% y/y in May 2022, versus 7.9% in April 2022, according to data from the National Institute of Statistics of Mozambique. |

| The International Monetary Fund (IMF) has stated that Mozambique’s request for an economic program, which began in January, could reach its board by the end of June. There is however no timeline for the conclusion of ongoing negotiations between both parties. |

Zambia

| Zambia’s China-led creditors held their first meeting with President Hakainde Hichilema on 16 June under the Group of 20’s Common Framework to discuss restructuring the nation’s debt. China will chair the creditors’ committee. |

| Zambia seeks financing assurances from its official creditors to win IMF board approval for its $1.4 billion bailout package. |

Cameroon

Read Also: Business Trends, Industry Insights & Policy Changes – VOL 3