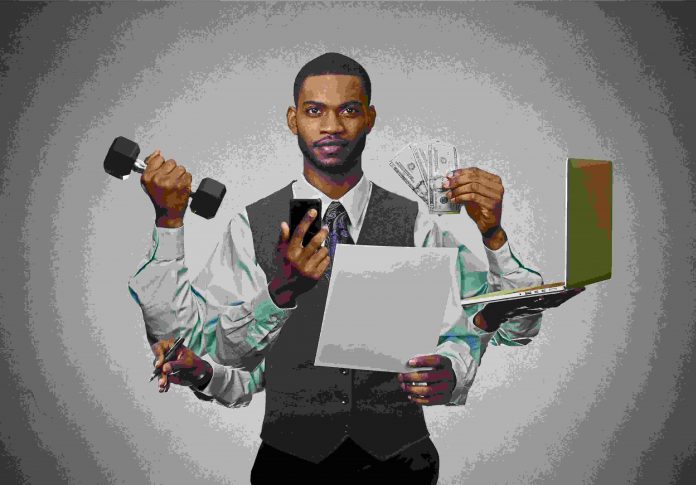

Achieving a truly healthy lifestyle encompasses more than just hitting the gym and eating well. It extends to your financial well-being, which is closely interconnected with your physical health. Striking a balance between fitness and finances can lead to a more harmonious and fulfilling life.

In this article, we’ll explore the connection between physical and financial well-being and provide advice on how to stay physically and financially fit simultaneously.

The Connection Between Physical and Financial Health

1. Stress Reduction: Both physical and financial stress can negatively impact your overall well-being. Stress is a common factor in various health issues, from high blood pressure to anxiety. Financial worries, such as debt or insufficient savings, can take a toll on your mental and physical health. Engaging in regular physical activity, on the other hand, helps reduce stress and boosts your mood.

2. Longevity: Investing in your physical health can lead to a longer, more fulfilling life. Regular exercise, a balanced diet, and proper healthcare can reduce the risk of chronic diseases and medical expenses in the long run, saving you money.

3. Energy Levels: Staying physically fit often translates to higher energy levels. With more energy, you can be more productive at work, potentially increasing your income and overall financial stability.

4. Self-Discipline: Both fitness and financial success require discipline and self-control. Setting and achieving fitness goals can transfer these skills to your financial life, helping you save, invest, and spend wisely.

Tips for Balancing Fitness and Finances

1. Set Realistic Goals: Whether it’s weight loss or financial independence, set achievable goals. Break them down into smaller, manageable steps. Celebrate your successes along the way to stay motivated.

2. Create a Budget: Just as you plan your workouts, create a financial budget. Allocate specific amounts for essentials, savings, investments, and discretionary spending. This will help you manage your money effectively and ensure that you’re saving for both short-term and long-term financial goals.

3. Prioritise Health and Exercise: Allocate time for physical activity in your schedule, just as you would for work or other obligations. Regular exercise doesn’t have to be expensive; you can choose affordable activities like walking, jogging, or home workouts.

4. Meal Planning and Budgeting: Plan your meals in advance to ensure a balanced diet while managing food expenses. Eating at home can be healthier and more cost-effective than dining out.

5. Emergency Fund: Build an emergency fund to cover unexpected expenses without derailing your financial plans. A robust financial safety net can reduce stress, which is beneficial for both physical and financial health.

6. Avoid Impulse Spending: Just as you should resist the temptation of unhealthy snacks, avoid impulse purchases. Before buying non-essential items, ask yourself if they align with your financial goals.

7. Seek Professional Guidance: Consider consulting professionals for both physical fitness and financial planning. Personal trainers and financial advisors can provide expert guidance tailored to your specific needs.

8. Stay Informed: Continuously educate yourself about health and finance. Understanding the latest trends, strategies, and best practices in both fitness and finance will empower you to make informed decisions.

Conclusion

Balancing physical and financial fitness is not only possible but highly rewarding. The synergy between these two aspects of your life can lead to improved overall well-being. By setting realistic goals, creating budgets, prioritising health, and seeking professional guidance when needed, you can achieve a harmonious balance that allows you to thrive physically and financially.

Remember that small, consistent efforts in both areas can lead to significant long-term benefits. As you embark on this journey towards holistic well-being, you’ll find that the positive effects of your physical and financial fitness efforts will amplify each other, contributing to a happier, healthier, and financially sound lifestyle.

Read Also: Mental Health Benefit of Regular Exercise