Nigeria,

a British protectorate adjoining other French colonial territories, was in the

middle of an economic boom and was the cornerstone of the West African economy.

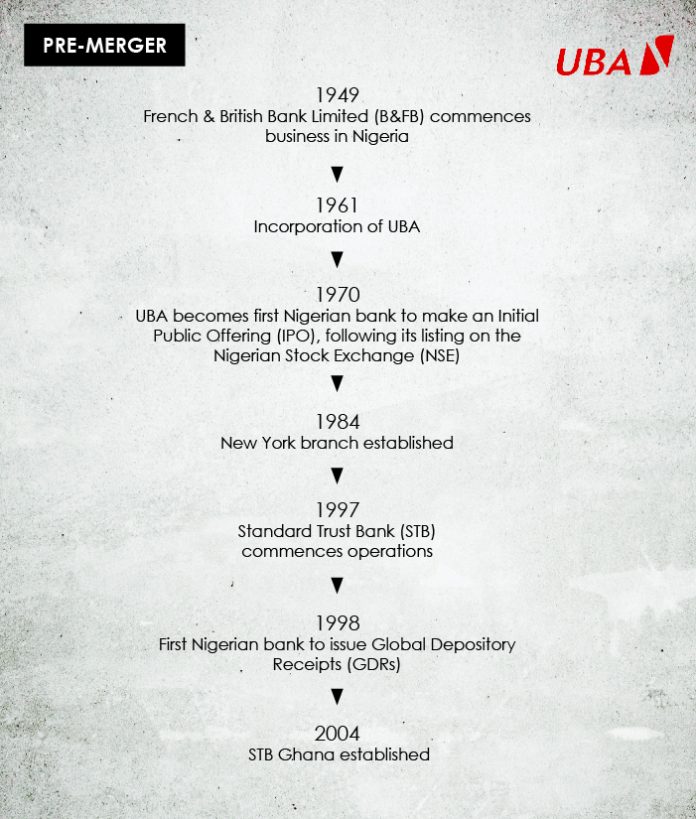

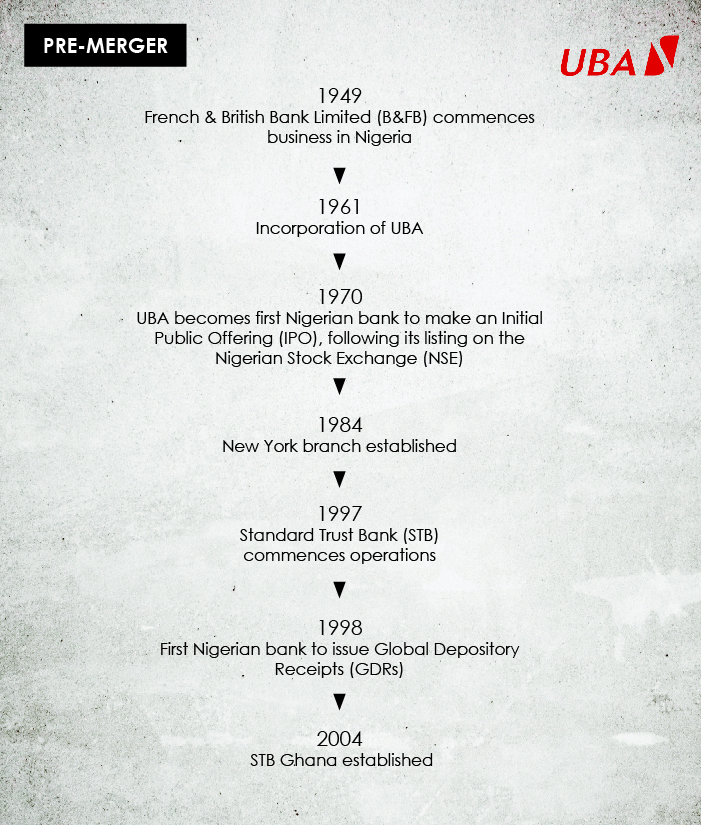

In late 1949, the British & French Bank launched its first branch in Lagos,

the economic capital of Nigeria.

B&FB

grew fast and attracted the interest of companies from various sectors of the

economy. In the following years, the B&FB network expanded to cover the

different regions in the country, opening offices in Kano in 1953, Ebute Metta

in 1955, Port-Harcourt and Apapa in 1956, Ibadan in 1958, Kaduna in 1960 and

Enugu in 1961.”

grew fast and attracted the interest of companies from various sectors of the

economy. In the following years, the B&FB network expanded to cover the

different regions in the country, opening offices in Kano in 1953, Ebute Metta

in 1955, Port-Harcourt and Apapa in 1956, Ibadan in 1958, Kaduna in 1960 and

Enugu in 1961.”

In

1958, new banking legislation was introduced, leading to the establishment of a

central bank in 1959 and the introduction of a new banking decree aimed at

improving governance over banks.

1958, new banking legislation was introduced, leading to the establishment of a

central bank in 1959 and the introduction of a new banking decree aimed at

improving governance over banks.

UBA

was then incorporated as a limited liability company on 23 February, 1961 taking

over the assets and liabilities of B&FB. It later became the first Nigerian

bank to make an Initial Public Offering (IPO), following its listing on the NSE

in 1970.

was then incorporated as a limited liability company on 23 February, 1961 taking

over the assets and liabilities of B&FB. It later became the first Nigerian

bank to make an Initial Public Offering (IPO), following its listing on the NSE

in 1970.

In

1997, an insolvent bank, Crystal Bank Limited was acquired by a young banker,

Tony O. Elumelu. The distressed bank was rechristened Standard Trust Bank (STB)

Limited and thus, began the journey to the actualization of a vision.

1997, an insolvent bank, Crystal Bank Limited was acquired by a young banker,

Tony O. Elumelu. The distressed bank was rechristened Standard Trust Bank (STB)

Limited and thus, began the journey to the actualization of a vision.

By the

end of 1997, barely 7 months after taking over, the STB team was able to turn

around Crystal Bank’s position of N6.49million to a whooping N473million.

end of 1997, barely 7 months after taking over, the STB team was able to turn

around Crystal Bank’s position of N6.49million to a whooping N473million.

The

STB brand was gradually being domesticated across all the other states in

Nigeria at a time when bank branches in the country were disproportionately

skewed towards commercial locations.

STB brand was gradually being domesticated across all the other states in

Nigeria at a time when bank branches in the country were disproportionately

skewed towards commercial locations.

When

Nigeria returned to democratic rule in May 1999 STB was already strategically

positioned to provide financial assistance through credit facilities packaged

for state and local governments, and secured with Irrevocable Standing Payment

Orders (SPOs) tied to the monthly financial allocations of state and local

governments from the Federation accounts. By the yearend of 1999, STB had

become the first Nigerian bank in history to declare annual profits that

exceeded the billion-naira mark. STB had suddenly become a bank to reckon with.

Nigeria returned to democratic rule in May 1999 STB was already strategically

positioned to provide financial assistance through credit facilities packaged

for state and local governments, and secured with Irrevocable Standing Payment

Orders (SPOs) tied to the monthly financial allocations of state and local

governments from the Federation accounts. By the yearend of 1999, STB had

become the first Nigerian bank in history to declare annual profits that

exceeded the billion-naira mark. STB had suddenly become a bank to reckon with.

In

2003, STB got listed on the Nigerian Stock Exchange.

2003, STB got listed on the Nigerian Stock Exchange.

By mid-2004,

STB was already the 5th largest bank in Nigeria and was comfortably aiming to

hit a N40 billion mark. The consolidation exercise presented an opportunity for

growth and the bank began to explore M&A options with the top 3 banks at

that time: First Bank, Union Bank, and UBA – the third largest bank in Nigeria.

STB was already the 5th largest bank in Nigeria and was comfortably aiming to

hit a N40 billion mark. The consolidation exercise presented an opportunity for

growth and the bank began to explore M&A options with the top 3 banks at

that time: First Bank, Union Bank, and UBA – the third largest bank in Nigeria.

“Today’s

UBA is an amalgamation of old STB and UBA – a fusion of legacy, strength, and

dynamism, agility and new energy,” says Tony Elumelu, the Chairman of United

Bank for Africa Plc.

UBA is an amalgamation of old STB and UBA – a fusion of legacy, strength, and

dynamism, agility and new energy,” says Tony Elumelu, the Chairman of United

Bank for Africa Plc.

In

January 2005, the merger of United Bank for Africa Plc with Standard Trust Bank

Plc was announced and by July 2005 the two banks had been effectively merged in

what was described as the biggest merger in the history of Nigeria’s capital

markets at that time. The new United Bank for Africa Plc took off on 1 August

2005 as Nigeria’s first mega bank. With a network of over 425 business offices

across the country, a balance-sheet size of over N600 billion, and an active

customer base of over 2 million, United Bank for Africa Plc ranks as the

biggest online, real-time bank in Nigeria and indeed sub-Saharan Africa.”

January 2005, the merger of United Bank for Africa Plc with Standard Trust Bank

Plc was announced and by July 2005 the two banks had been effectively merged in

what was described as the biggest merger in the history of Nigeria’s capital

markets at that time. The new United Bank for Africa Plc took off on 1 August

2005 as Nigeria’s first mega bank. With a network of over 425 business offices

across the country, a balance-sheet size of over N600 billion, and an active

customer base of over 2 million, United Bank for Africa Plc ranks as the

biggest online, real-time bank in Nigeria and indeed sub-Saharan Africa.”

From

then, UBA commenced its pan-African expansion strategy, which has led to its

presence in Republique du Benin, Burkina Faso, Cameroun, Congo Brazzaville,

Congo DRC, Cote d’lvoire, Gabon, Ghana, Guinea, Kenya, Liberia, Mali,

Mozambique, Nigeria, Senegal, Sierra Leone, Tanzania, Tchad, Uganda and Zambia.

then, UBA commenced its pan-African expansion strategy, which has led to its

presence in Republique du Benin, Burkina Faso, Cameroun, Congo Brazzaville,

Congo DRC, Cote d’lvoire, Gabon, Ghana, Guinea, Kenya, Liberia, Mali,

Mozambique, Nigeria, Senegal, Sierra Leone, Tanzania, Tchad, Uganda and Zambia.

Today,

UBA plays a leading role in private and public sector partnerships aimed at

supporting the acceleration of Africa’s economic development, and with

operations in the United States of America, the United Kingdom and presence in

France, UBA’s remarkable African footprint makes it the bank of choice for

Africans and African businesses as well as players in the global and other

emerging markets.

UBA plays a leading role in private and public sector partnerships aimed at

supporting the acceleration of Africa’s economic development, and with

operations in the United States of America, the United Kingdom and presence in

France, UBA’s remarkable African footprint makes it the bank of choice for

Africans and African businesses as well as players in the global and other

emerging markets.

So illuminating…

PLEASE READ!!Hello Guys!!! I am Caro I live in Ohio USA I’m 32 Years old, am so happy I got my blank ATM card from Adriano. My blank ATM card can withdraw $4,000 daily. I got it from Him last week and now I have withdrawn about $10,000 for free. The blank ATM withdraws money from any ATM machines and there is no name on it because it is blank just your PIN will be on it, it is not traceable and now I have money for business, shopping and enough money for me and my family to live on.I am really glad and happy i met Adriano because I met Five persons before him and they could not help me. But am happy now Adriano sent the card through DHL and I got it in two days. Get your own card from him right now, he is giving it out for small fee to help people even if it is illegal but it helps a lot and no one ever gets caught or traced. I’m happy and grateful to Adriano because he changed my story all of a sudden. The card works in all countries that is the good news Adriano's email address is adrianohackers01@gmail.com