As you grow older or begin your journey into

the ‘real world’, you are faced with reality. You realize that dreams are different

form reality.

the ‘real world’, you are faced with reality. You realize that dreams are different

form reality.

To solve this problem, financial literacy is important.

If you don’t have any personal finance books in

your collection, it’s time to own one. We’ve made a list, check it out.

your collection, it’s time to own one. We’ve made a list, check it out.

1. Rich

Dad Poor Dad-Robert Kiyosaki

Dad Poor Dad-Robert Kiyosaki

This must-read book is a gem. It is a memoir with lessons attached.

It emphasizes the difference between assets (things

that generate cash flow) and liabilities (things that don’t).

It’s relatable, easy to read and most importantly, inspiring.

It emphasizes the difference between assets (things

that generate cash flow) and liabilities (things that don’t).

It’s relatable, easy to read and most importantly, inspiring.

Robert Kiyosaki used two very clear polar examples

– ‘Rich Dad’ and ‘Poor Dad’ – and broke down the differences between

them.

– ‘Rich Dad’ and ‘Poor Dad’ – and broke down the differences between

them.

2. Refinery29 Money Diaries-Lindsey Stanberry

Refinery29 takes the best of

the Money Diaries feature and

organizes it into a lovely book. You get to read about people of all ages,

ethnicities, locations, careers, etc., and their relationships with money.

the Money Diaries feature and

organizes it into a lovely book. You get to read about people of all ages,

ethnicities, locations, careers, etc., and their relationships with money.

A money diary is simple: Note

your income and monthly expenses, record every dollar you spend for a week (or

a month or whatever), and take a look at how those numbers are affecting your

life.

your income and monthly expenses, record every dollar you spend for a week (or

a month or whatever), and take a look at how those numbers are affecting your

life.

This is a great,

all-encompassing personal finance book for young people.

all-encompassing personal finance book for young people.

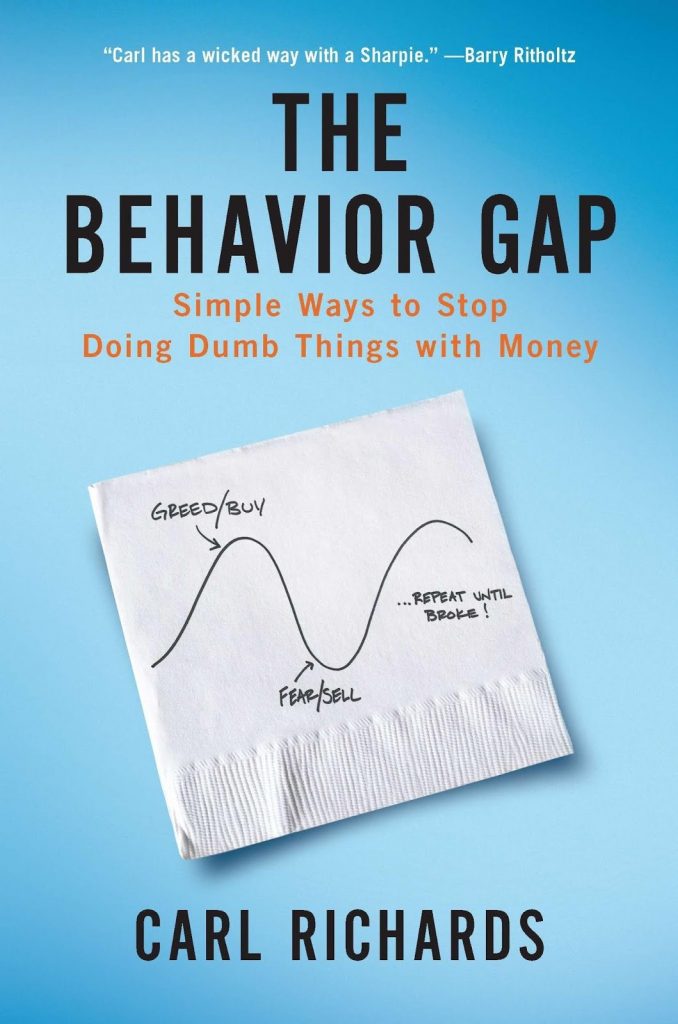

3. The Behavior Gap-Carl

Richards

Richards

This is a book about investing.

Carl Richards talks about bad decisions people tend to make when it comes to

investing, especially when they follow crowd mentality. It’s best for investors

at all levels, from beginner to expert

Carl Richards talks about bad decisions people tend to make when it comes to

investing, especially when they follow crowd mentality. It’s best for investors

at all levels, from beginner to expert

4. Happy

Go Money-Melissa

Leong

Go Money-Melissa

Leong

This is a fun personal

finance/self-help combo. Happy Go Money teaches us how to find joy with money. Using humor and kindness, Leong shares a lovely starter guide to living a happier

life with a better relationship to your money.

finance/self-help combo. Happy Go Money teaches us how to find joy with money. Using humor and kindness, Leong shares a lovely starter guide to living a happier

life with a better relationship to your money.

5. The

Rules of Wealth-Richard

Templar

Rules of Wealth-Richard

Templar

If you prefer a straight-to-the

point, concise and good advice personal finance book, this is the one.

point, concise and good advice personal finance book, this is the one.

It’s an ethical book dedicated

to teaching you how to generate more money, handle it more wisely, grow it and

also the importance of staying humble and giving to charity.

to teaching you how to generate more money, handle it more wisely, grow it and

also the importance of staying humble and giving to charity.

To

move forward and become successful, you need to reprogram your mind about

money. You can begin by reading books on personal finance. You’ll need the knowledge

to help you get it right.

move forward and become successful, you need to reprogram your mind about

money. You can begin by reading books on personal finance. You’ll need the knowledge

to help you get it right.

This must-read book is a gem. It is a memoir with lessons attached. It emphasizes the difference between assets (things that generate cash flow) and liabilities (things that don’t). It’s relatable, easy to read and most importantly, inspiring. E_HYCPS_60 dumps

I can tell you some useful info if you want to know how to Catch a Cheater. It's really important to know in modern world