Nigeria

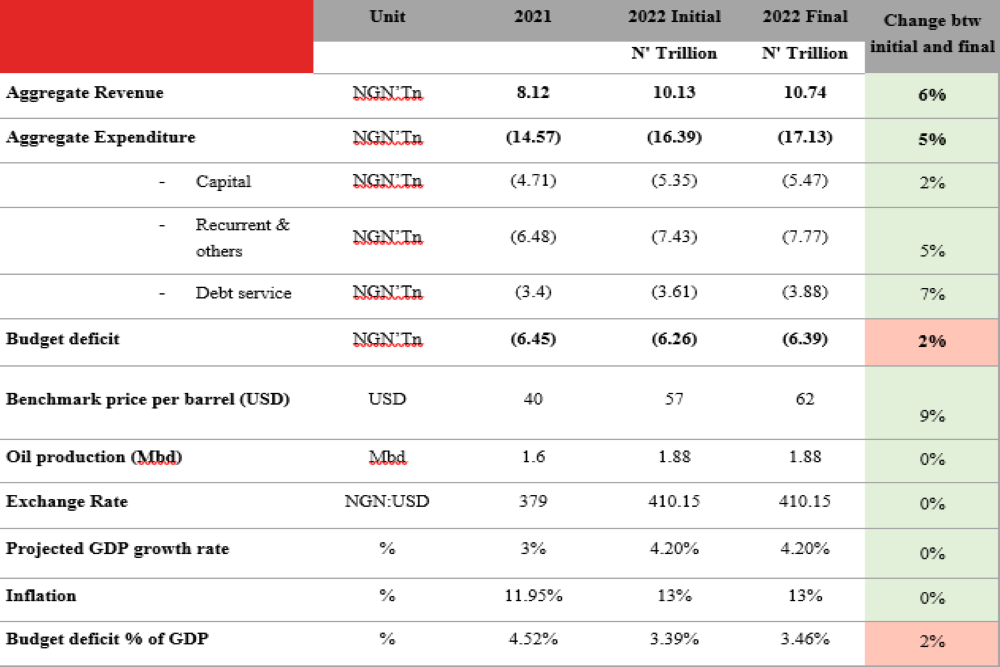

President Muhammadu Buhari signed the 2022 budget of ₦17.13 trillion on December 31, 2021. This budget is 4.51% (₦735.85 billion) higher than the initial budget of ₦16.39 trillion presented to the National Assembly on October 6, 2021. It is also 26.05% higher than the 2021 budget of ₦13.59 trillion. The approval of the budget will facilitate a timely implementation and support economic recovery.

Approximately ₦6.9 trillion and ₦5.4 trillion was allocated to recurrent expenditures and capital expenditures (CapEx) respectively. Some of the assumptions of the budget include oil price benchmark of $62 per barrel, fiscal deficit of ₦6.39 trillion (3.46% of GDP) and exchange rate of ₦410.15/$.

The Federal Government has announced the introduction of excise duty of ₦10/litre on all non-alcoholic, carbonated and sweetened beverages in the country. The new policy referred to as ‘Sugar Tax’, is part of the recently signed Finance Act. According to the Minister of Finance, the sugar tax was introduced to raise revenues for health-related expenditure in line with the 2022 budget. Nigeria’s fiscal deficit has risen to ₦7.05 trillion and 4.3% of GDP as of November 2021. Effective revenue mobilization strategies can help address the country’s fiscal deficit.

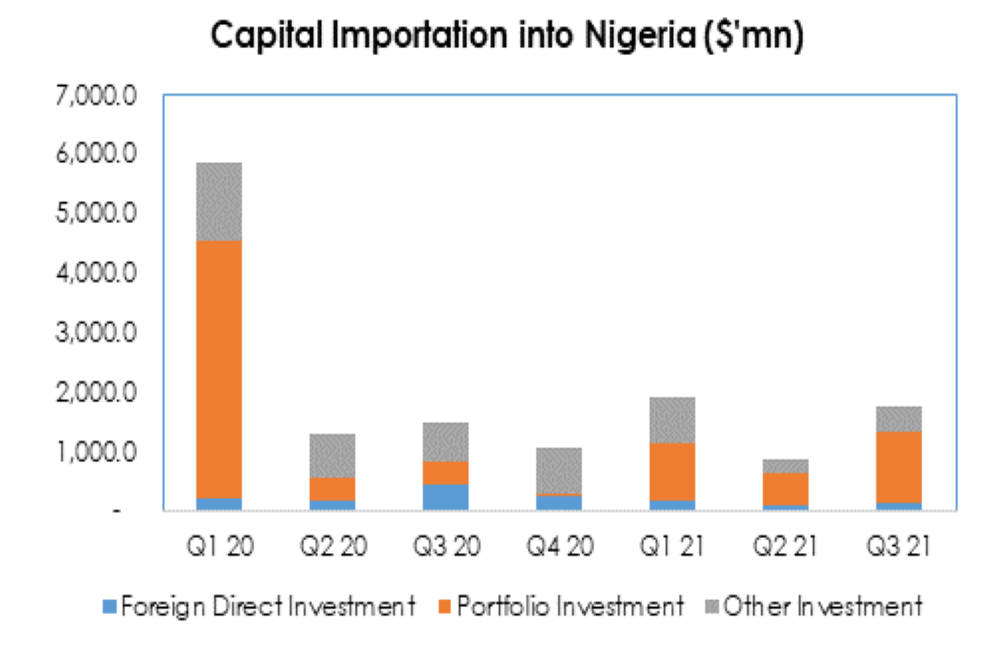

According to the Nigeria Bureau of Statistics (NBS), the country’s capital importation increased by 97.7% from Q2 2021 to $1.73 billion in Q3 2021. The largest amount of capital importation by type was received through portfolio investment, which accounted for 70.30% ($1.2 billion) of total capital importation. Capital importation supported inflows into the CBN’s FX reserve over the quarter.

Senegal

The 125 megawatts (MW) Sendou coal-fired power project has been revived and has begun delivering commercial power to state utility Socíete Nationale d’Electricite du Śeńegal’s (Senelec)’s grid. The plant halted operations in 2019, following years of opposition and issues. The revived 125MW coal-plant will boost Senegal’s electricity-generation capacity and distribution capabilities, which will improve power access across the country. More than 70% of Senegalese currently have access to electricity. Improved access to power will increase productivity and promote the country’s industrial development.

Senegal has inaugurated a new $1.3 billion commuter railway in its capital city, Dakar. The new rail line will link Dakar, the country’s capital, to Diamniadio, the new town currently undergoing development. The project is part of Senegal’s emergent plan that is aimed at urban renewal and transit improvement in the Dakar metropolis. Improvements in traffic management and downtime will increase workers’ productivity and attract tourists who have shown an increasing preference for Senegal and Gambia, in recent times.

Togo

Togo’s cocoa and coffee exports declined by 47% and 23% respectively, in the just ended 2020/2021 crop season compared to the prior season. The volume of cocoa beans exported in the season fell to 5,400 metric tons in 2020/2021 season, compared with 10,200 metric tons in the 2019/2020 season, while Robusta coffee exports were lower at 2,000 metric tons from 2,600 metric tons in the prior year.

The decline in Togo’s cocoa and coffee exports is unfavourable to the country’s export earnings. Furthermore, it has a negative impact on the country’s trade position and its external reserves. Lower export earnings will exert pressure on government revenue, widening its fiscal deficit.

Kenya

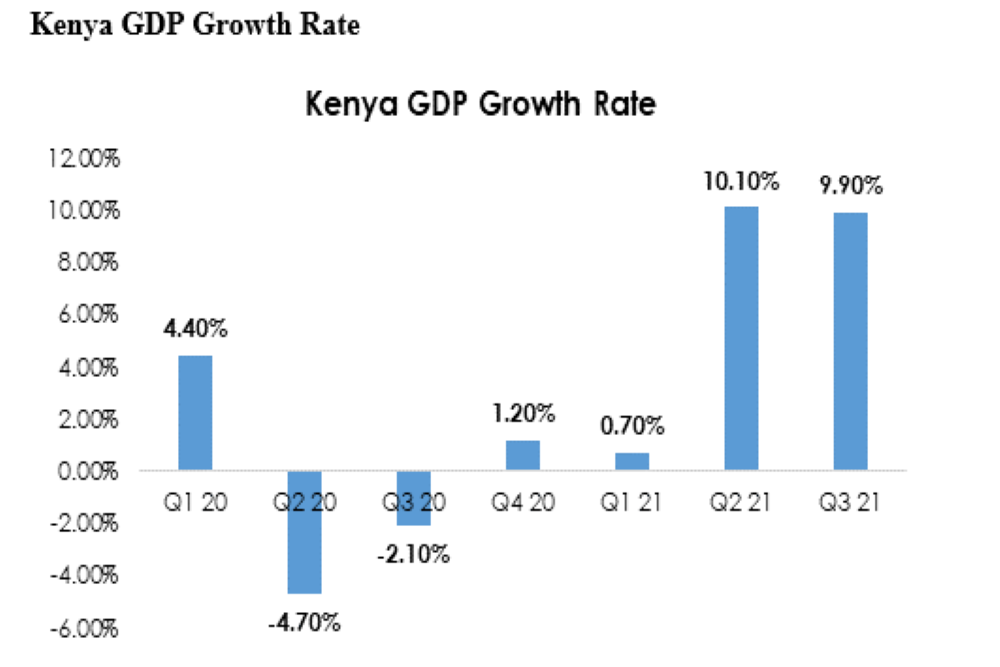

Kenya’s GDP growth slowed to 9.9% in Q3 2021, from an upwardly revised 11.9% in Q2 2021. Kenya’s Central Bank estimates an expansion of 6.4% in 2021 from -0.3% in 2020, higher than the World Bank’s projection (5%) and below the 6.6% projected by the Kenyan government. The country’s inflation fell slightly to an 11-month low of 5.7% in December from 5.8% in November driven by falling food prices.

Although Kenya’s GDP slowed, it is still on a growth trajectory. This implies that Kenya is recovering from its biggest contraction in almost three decades. The continuous expansion of the country’s economy is beneficial for investor confidence and will increase its attractiveness to more investors. This is positive for consumer real income and the country’s real GDP growth in Q4 2021.

Uganda

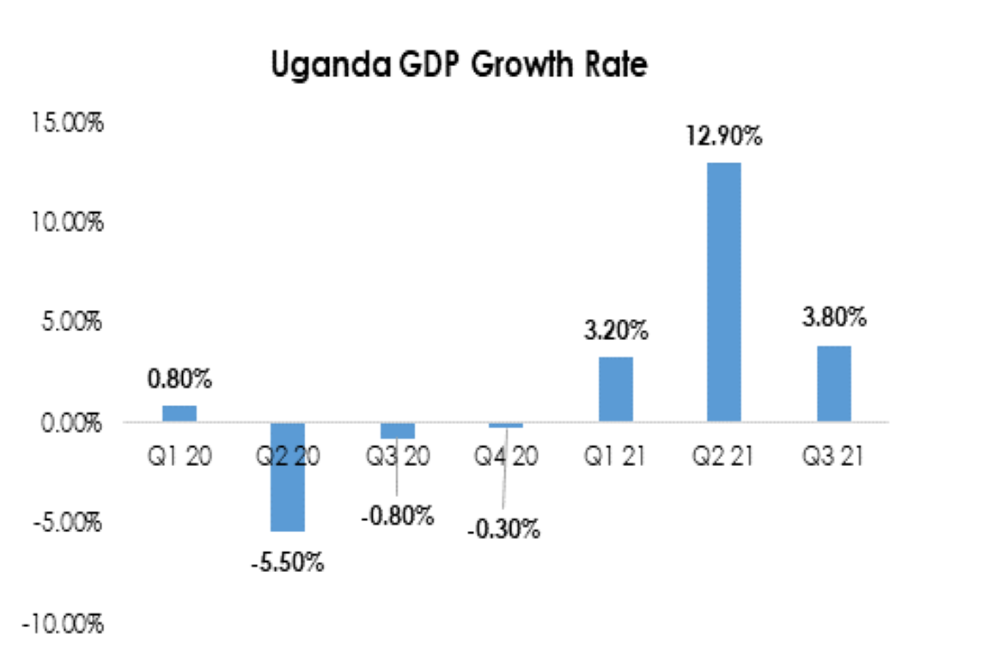

The Ugandan economy expanded by 3.8% in Q3 2021, compared to a revised record 12.9% growth in Q2 2021. This is its third consecutive quarterly growth. On a seasonally adjusted quarterly basis, the GDP fell by 0.9% from a 4% growth in the previous period.

The positive growth reported in Q3 2021 is the country’s third consecutive quarterly growth in 2021, reflecting the economy’s continued recovery following the adverse after-effects of the pandemic. This should boost business and investor confidence. Moreover, the growth of the services and agriculture sectors will support job creation, which should drive economic growth. This will further boost Uganda’s attractiveness to investors. The services and agriculture sectors account for 44.73% and 31.05% of GDP, respectively. Furthermore, the country’s real returns on investment remain positive with its benchmark interest rate (6.5% p.a.) significantly above its inflation rate of 2.9%. This is attractive to investors and can encourage higher investment inflows, which will lend further support to Uganda’s continued economic rebound.

Tanzania

According to the Bank of Tanzania, the country’s oil-import bill increased by 1.3% to $1.58 billion in the 12 months through June 2021, mainly due to an increase in volume. During the period, oil accounted for 18% of Tanzania’s import bill. There are expectations of higher oil prices given the recent growth in global demand. As a net oil importer, increases in oil prices will result in a higher import bill. This will further widen Tanzania’s trade deficit, resulting in a deterioration of the country’s terms of trade. As of September, Tanzania’s trade balance stood at -$562.30 million. Furthermore, a rise in the country’s import bill will exert pressure on external reserves and the exchange rate. Given that oil accounts for 20% of the country’s import bill, a further rise in global oil prices will have an immediate impact on fuel prices.

In September, domestic pump prices of gasoline, diesel and kerosene recorded an annual increase of 30.7%, 25.6% and 26.3% respectively. A rise in fuel prices will raise the cost of logistics for businesses and heighten inflationary pressures in the coming months. In November, Tanzania’s inflation rose to 4.1%

Read Also: Business Trends, Policy Insights & Policy Changes-Vol 1

Ethiopia

Ethiopia wants to pass a supplementary budget of about 122 billion birr ($2.47 billion) to help fund programs, rebuild areas affected by war and provide humanitarian aid. The extra allocation for the financial year ending July 7, 2022 will bring total spending for the year to 683.7 billion birr ($13.84 billion). The supplementary budget will be spent on security, humanitarian aid and on rehabilitating infrastructure. It will also be used to financially support businesses and households affected by the ongoing war in the northern part of Ethiopia.

The increased government spending is positive for the country’s economic growth outlook and will aid its recovery from the war. The Economist Intelligence Unit (EIU) projects that the country will grow by 2% in 2021 and by 3.3% in 2022. This is favourable for investor confidence and would boost the attractiveness of the country to foreign investment inflows.

Cameroon

Cameroon seeks the financial support of the Export-Import Bank of China (China Eximbank) for the construction of the long planned 72MW Menchum hydroelectric power dam, in an effort to boost the country’s hydroelectric power (HEP) schemes. In 2015, the government selected a consortium of Canadian and US firms CIMA International and ARQ Engineering as project managers, with China International Water & Electric Corporation (CWE) as the construction contractor. If the loan is approved, this will aid the construction of the 72MW Menchum hydroelectric power dam.

Upon completion, it will boost the power supply to the national grid and increase the country’s electrification rate. It will also bolster the productivity of key sectors such as mining, oil and gas and agriculture, which is positive for job creation. An improved power supply will also increase the attractiveness of the country to more investors and businesses. This is positive for the country’s GDP growth and economic recovery process. However, the loan will increase the debt stock and debt service cost of Cameroon. The country’s debt-to-GDP ratio rose to 43.20% in 2020 from 41.70% in 2019.

DRC Democratic Republic of Congo

Following a period of macroeconomic stability, the Democratic Republic of Congo’s Central Bank expects to cut its main interest rate by 100 basis points (bps) to 7.5% in 2022. The country’s real GDP expanded by an estimated 5.7% in 2021, a robust recovery from the negative growth of -2.40% in the preceding year.

The bank’s decision to further lower its benchmark interest rate will reduce borrowing costs and drive private credit growth. The lower cost of borrowing will encourage business investment, which will have positive multiplier effects on the economy. Democratic Republic of Congo’s real GDP is expected to accelerate to 6.1% in 2022. Even with a further reduction of its monetary policy rate, the country’s real return on investment remains positive. This is positive for investor confidence and can encourage higher investment inflows to the country.

Zambia

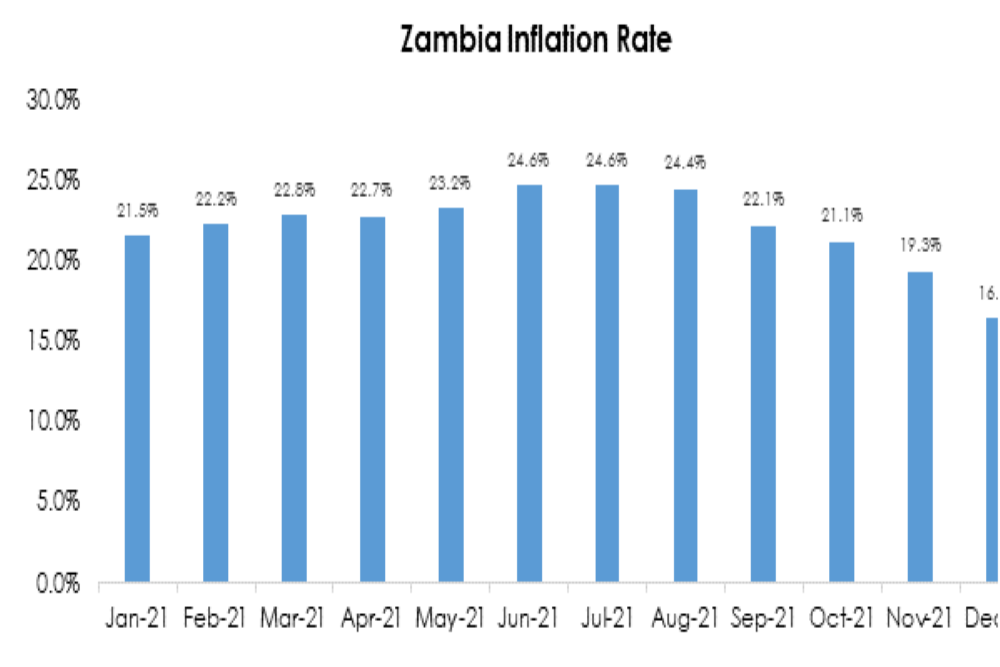

Zambia’s headline inflation eased to 16.4% in December, from 19.3% in November, mainly due to lower food prices. This is the lowest rate since October 2020. Food inflation fell further to 19.9% in December, from 25.4% in the previous month. Meanwhile, month-on-month, consumer prices grew 0.6%, the same pace as November.

The sustained decline in Zambia’s inflation may cause the Bank of Zambia to keep the benchmark interest rate unchanged at its next Monetary Policy Committee (MPC) meeting, which is scheduled for February 2022. This will give the Monetary Policy Committee enough room to assess the impact of the November 50bps interest rate hike, and the effect a stronger currency would have on imported consumer goods. Following the International Monetary Fund (IMF) agreement to an extended credit facility earlier in December, the Zambian kwacha has appreciated by 7%.

At UBA, we offer corporate banking services to help with your day-to-day business needs.