United Bank for Africa (UBA) Plc and Unified Payment

Systems Limited are set to change the way Nigerians pay for items with the introduction of “PayAttitude”

Systems Limited are set to change the way Nigerians pay for items with the introduction of “PayAttitude”

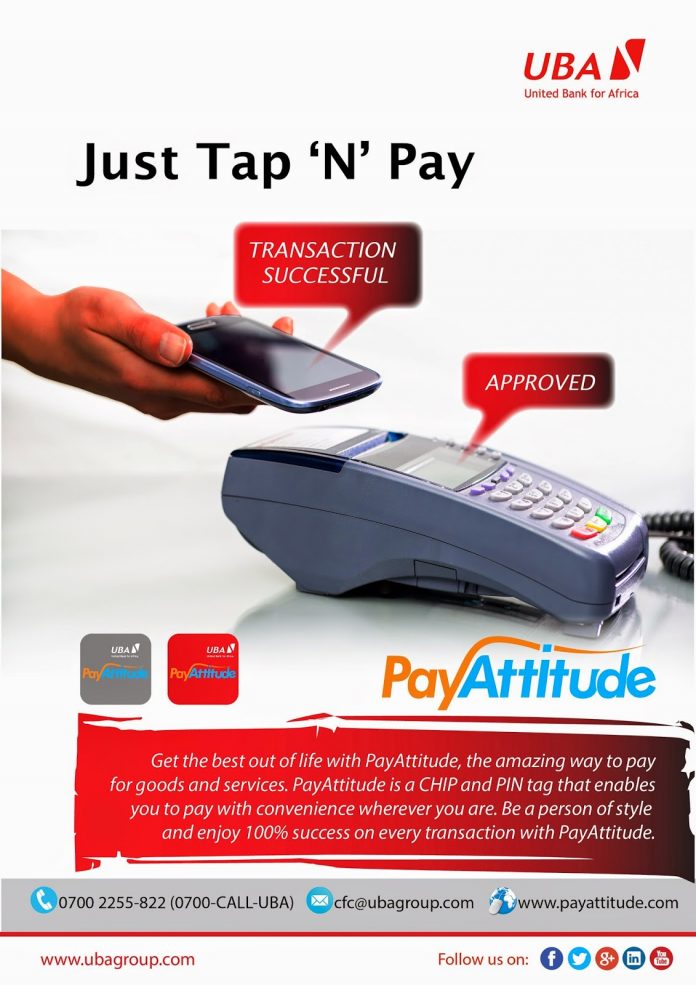

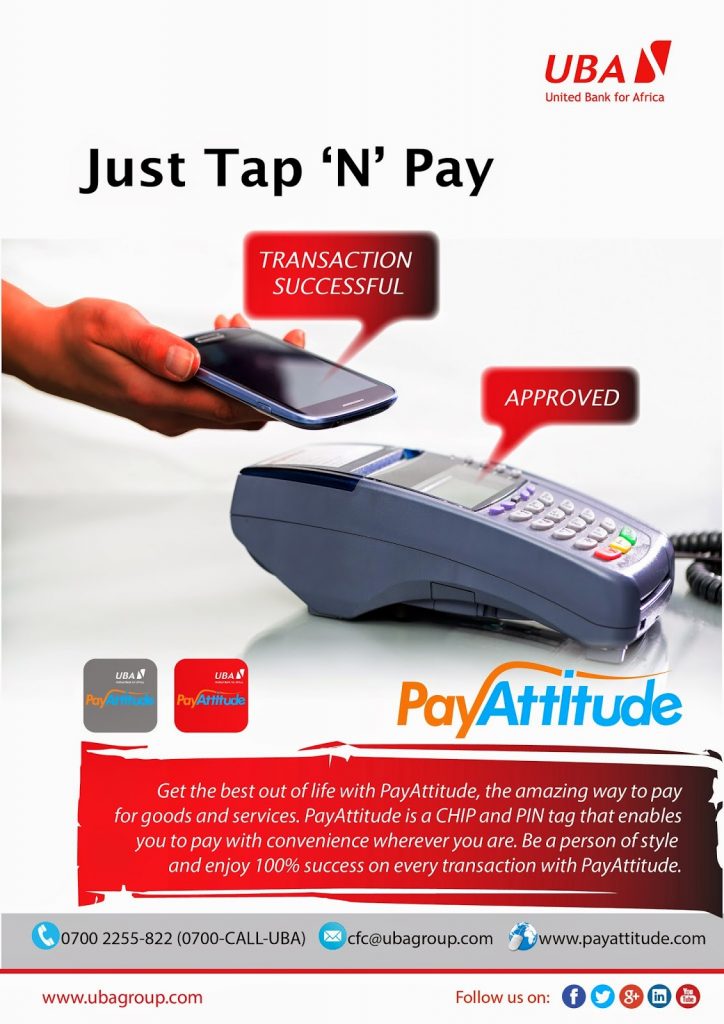

PayAttitude is a fast, seamless, and contactless

payment device.

payment device.

It works based on Near

Field Communication (NFC) technology. It comes as an adhesive tag that is attached to the mobile phones of customers which automatically turns the mobile phone into a payment device that can be used to pay for items at at any PayAttitude enabled POS terminal in any shop.

Field Communication (NFC) technology. It comes as an adhesive tag that is attached to the mobile phones of customers which automatically turns the mobile phone into a payment device that can be used to pay for items at at any PayAttitude enabled POS terminal in any shop.

Making payments with PayAttitude is as

easy as tapping the phone against a PoS terminal. Highly convenient for retail

transactions, it perfectly suits the lifestyle of mobile phone users.

easy as tapping the phone against a PoS terminal. Highly convenient for retail

transactions, it perfectly suits the lifestyle of mobile phone users.

“The tag can be

obtained from designated UBA business

offices. We have the PayAttitude Debit and PayAttitude Prepaid depending

on a customer’s preference” explained Yinka Adedeji, UBA’s Divisional Head for e-Banking explains that

obtained from designated UBA business

offices. We have the PayAttitude Debit and PayAttitude Prepaid depending

on a customer’s preference” explained Yinka Adedeji, UBA’s Divisional Head for e-Banking explains that

A major benefit of the new payment

solution is that all payments are always 100% successful with or without

network connectivity, thereby eliminating the issue of “declined” payments on

POS terminals.

solution is that all payments are always 100% successful with or without

network connectivity, thereby eliminating the issue of “declined” payments on

POS terminals.

It thus guarantees subscribers the confidence and comfort of

always being able to pay for goods and services at merchant locations at all

times notwithstanding network challenges.

always being able to pay for goods and services at merchant locations at all

times notwithstanding network challenges.

This innovative payment solution is

coming after UBA recently upgraded its IT system to a more efficient, secure

and faster banking platform enhancing the speed of the bank’s e-platforms

including; internet banking, mobile banking and also greatly improving the

uptime and availability of its e-Channels like the POS machines and ATMs.

coming after UBA recently upgraded its IT system to a more efficient, secure

and faster banking platform enhancing the speed of the bank’s e-platforms

including; internet banking, mobile banking and also greatly improving the

uptime and availability of its e-Channels like the POS machines and ATMs.

The new payment solution

“PayAttitude” synchs perfectly with the bank’s upgraded banking platform

delivering superior banking experience to UBA customers across Africa as well

as with advanced security and compliance framework which will result in

significant improvement in productivity and improved response to security and

regulatory issues.

“PayAttitude” synchs perfectly with the bank’s upgraded banking platform

delivering superior banking experience to UBA customers across Africa as well

as with advanced security and compliance framework which will result in

significant improvement in productivity and improved response to security and

regulatory issues.

As

a highly diversified financial services provider and leading provider of

innovative e-banking solutions across Africa, UBA is one of the largest

financial institutions in Africa, with offices in New York, London and Paris.

a highly diversified financial services provider and leading provider of

innovative e-banking solutions across Africa, UBA is one of the largest

financial institutions in Africa, with offices in New York, London and Paris.

The UBA Group has strong retail penetration across the African continent with

more than 8 million customers. These customers enjoy a bouquet of products and

services tailored to meet their different financial needs backed by cutting

edge technology that offers secured and convenient real-time online banking

services.

more than 8 million customers. These customers enjoy a bouquet of products and

services tailored to meet their different financial needs backed by cutting

edge technology that offers secured and convenient real-time online banking

services.

The new payment solution “PayAttitude” synchs perfectly with the bank’s upgraded banking platform delivering superior banking experience to UBA customers across Africa as well as with advanced security and compliance framework which will result in significant improvement in productivity and improved response to security and regulatory issues. FC0-U61 exams dumps

wao so interesting but i hope no any effect ?

I've seen this post before. But I don't remember which sites I've seen. Hope it's not a problem for you.

Research paper is a complicated and long-term task. Follow this link to know how it should be written!

Thanks for sharing such a nice Blog.I like it.

Purchase Bitdefender 2019 and Get These Latest Security and Performance Characteristics

Norton AntiVirus Overview – Why You'll Need This Superior Security Program for Your PC

Thanks for sharing such a nice Blog.I like it.

renew norton

Thanks for sharing such a nice Blog.I like it.

norton com setup

mcafee.com/activate

AVG contact number

Outlook Phone number

Thanks for sharing such a nice Blog.I like it.

Avast Customer Service

McAfee Customer Service Phone Number

AVG Customer Service Number

kaspersky customer service

hp printer support number

Thanks for sharing such a nice Blog.I like it.

stocktwits

prusaprinters

musescore

indiegogo

wantedly

efunda

edn

Thanks for sharing such a nice Blog.I like it.

Malwarebytes Support

Thanks for sharing such a nice Blog.I like it.

Guest Posting Services

Guest Posting Services

Guest Posting Services

Guest Posting Services

Thank you for sharing with us such a great blog. I would like to share my experience with you as well.

I'm an author on the travel blog and I travel around the world a lot

delta airlines telephone number customer service

south west phone number in spanish

air canada customer service phone number

alaska airlines visa customer service phone number

With the advent of the internet, everything has transformed into its electronic version, Banking is not far behind. You can find online banking solution using ReVoult app. Get it here – cloudbase3.com/revolut-review

I have scrutinized your blog its engaging and imperative. I like your blog.

terracotta jewellery online shopping

terracotta jewellery online

silk sarees online shopping

cotton sarees online

silk sarees online

Norton com setup product key

Malwarebytes popup won't go away

McAfee activate

Hp envy 5055 ink cartridge

Norton product key

Remove malwarebytes mac

Avg activate

McAfee activate product key

Group buy seo tools

Seo group buy

Group seo tools

Group seo tools buy

Best seo group buy tools

Group buy seo tools india

Group buy seo tools india

Get answers to all your technical queries here.

globalemployees

Most useful PHP libraries in 2020

globalemployees