The new Digital Experience is now on Web

Banking made just for you, anywhere, anytime, any device.

Available on

The new Digital Experience is a mix of convenience, support, flexibility and fun across any device.

Log into your account on the new UBA Mobile App and new UBA Internet Banking with same login details. Sign up once on the new UBA Mobile App and login with the same details for all devices.

What's new?

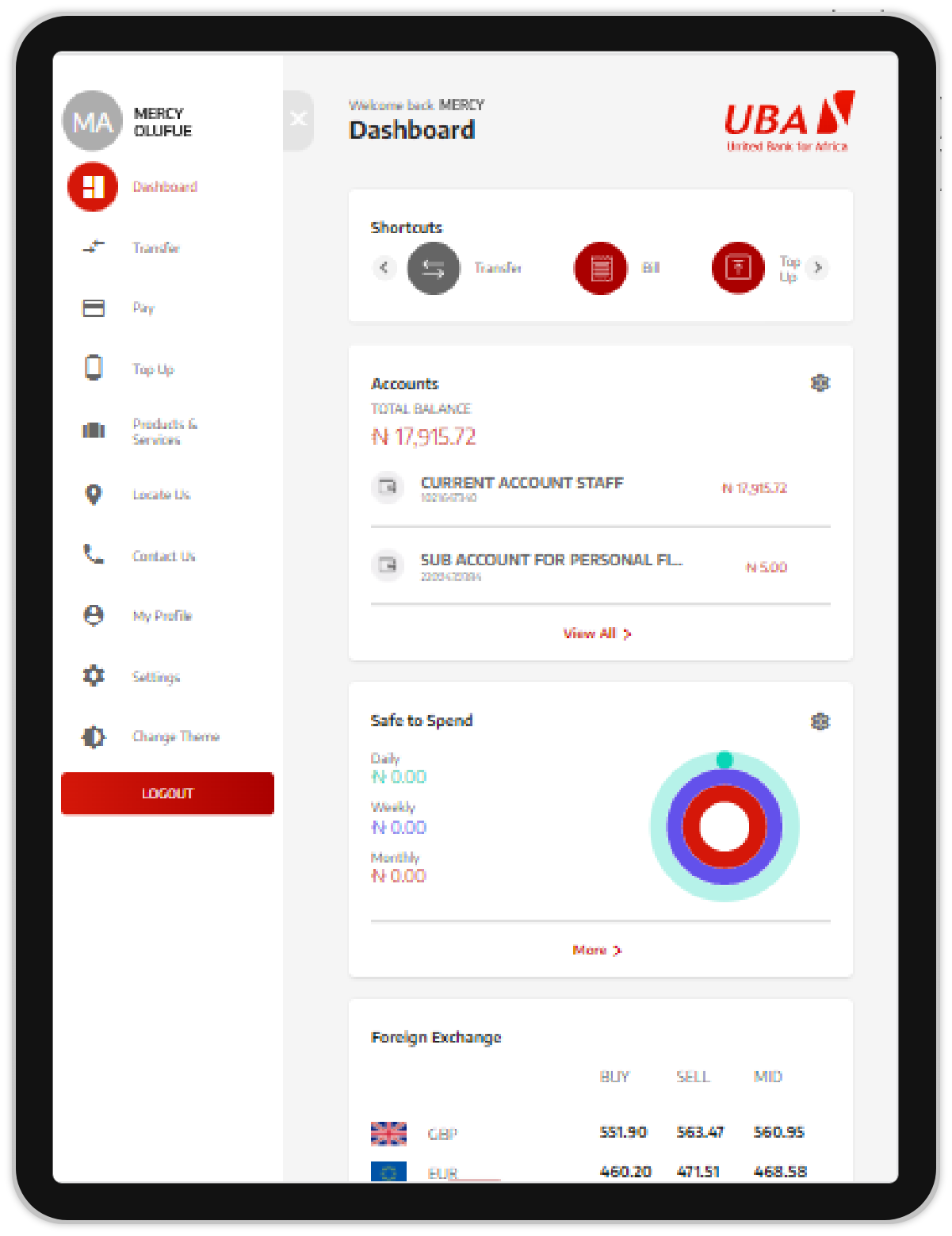

Access your accounts anywhere, anytime on any device.

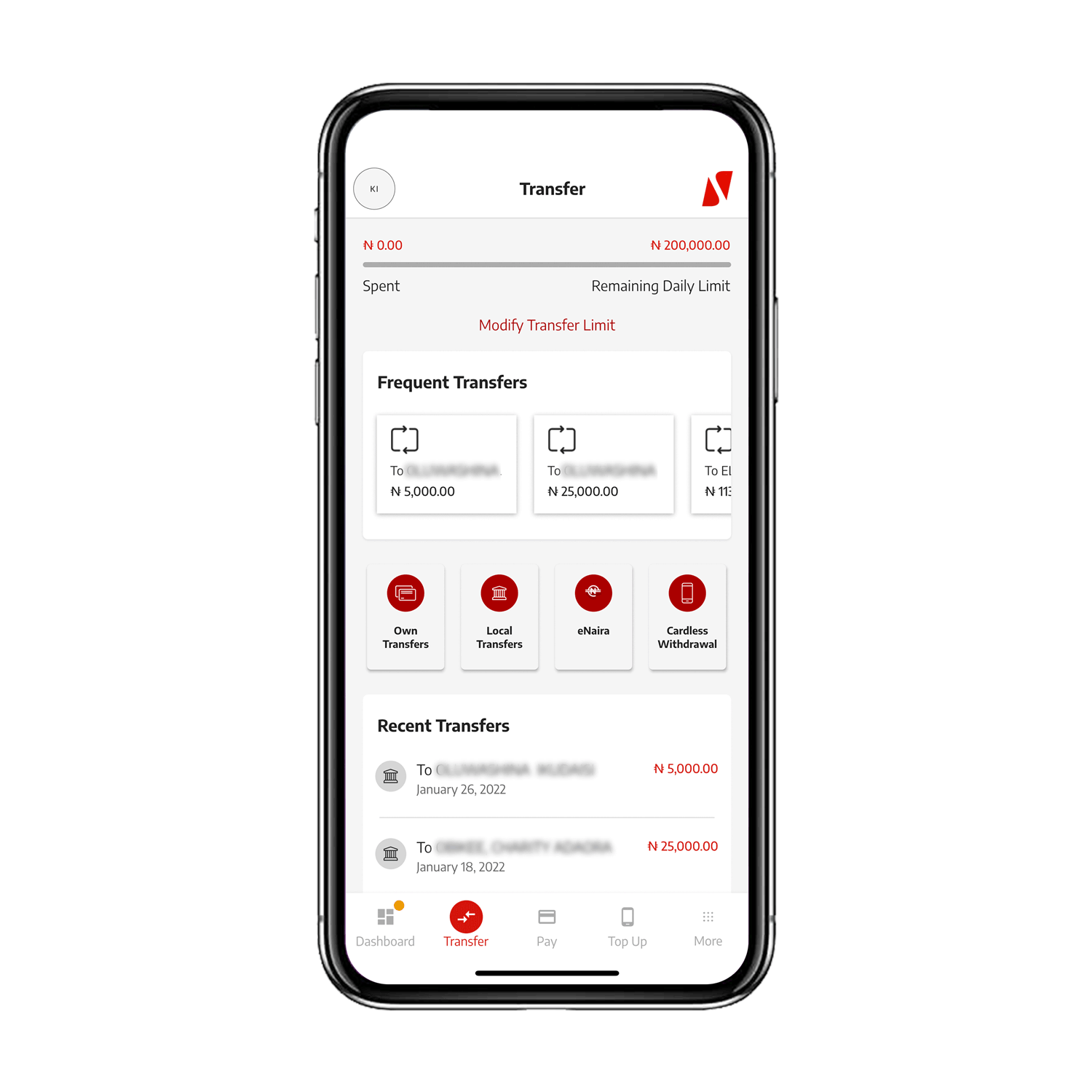

Sign Up once and for all device

Sign up once on the new UBA Mobile App to carry out all your transactions from any device. You can easily login with the same details or scan the QR on web with your UBA Mobile App.

All your favourite transactions on any device

Send money, pay bills, top up airtime, save for a goal and more from any device.

Create a shortcut to all your repeated transactions

You can schedule your transaction, monitor upcoming payment and create a shortcut for your most frequent transaction.

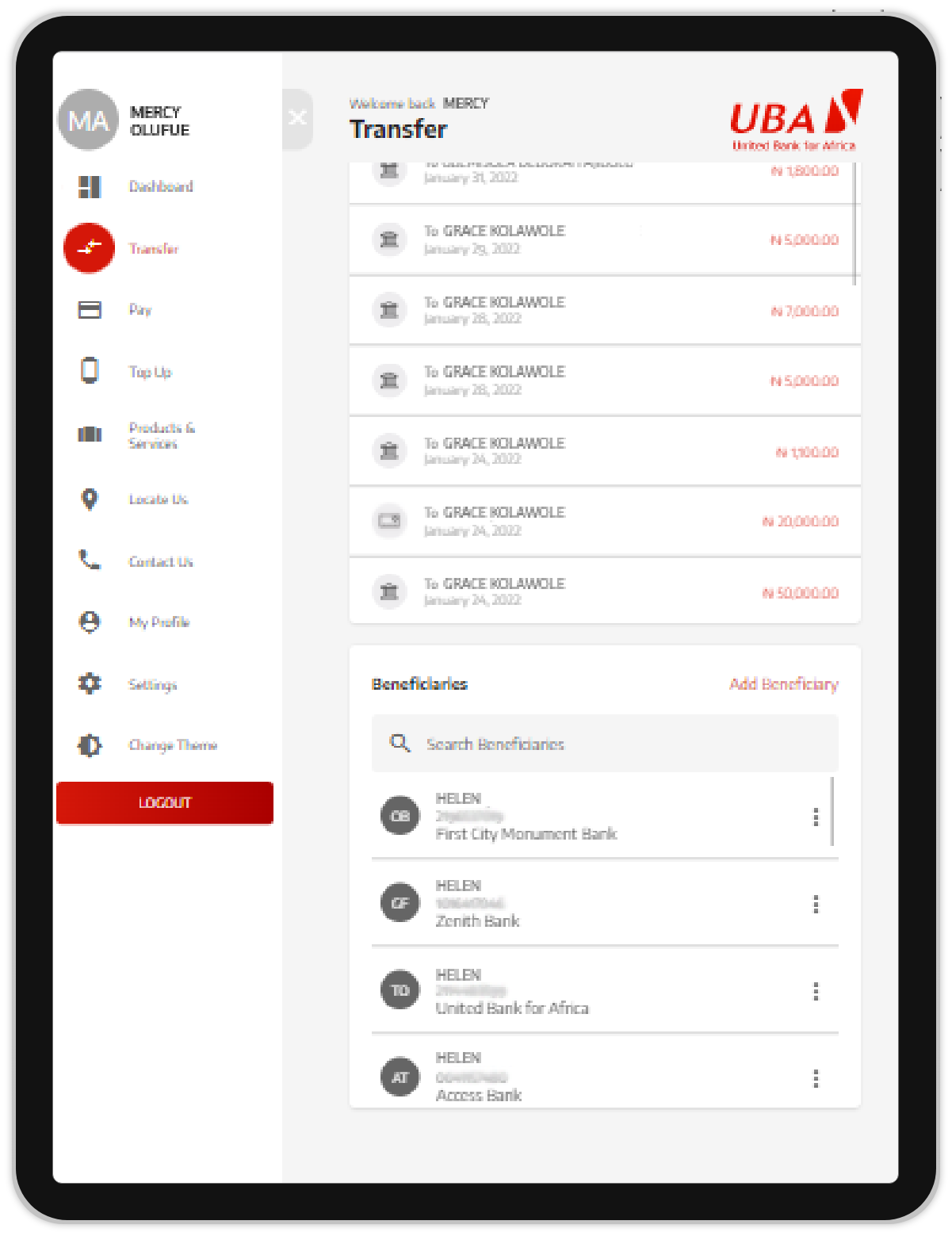

Access your saved beneficiaries on any device

You do not need to save your beneficiary’s account details multiple times on different platforms. Save them once on one device and send money to them on any device.

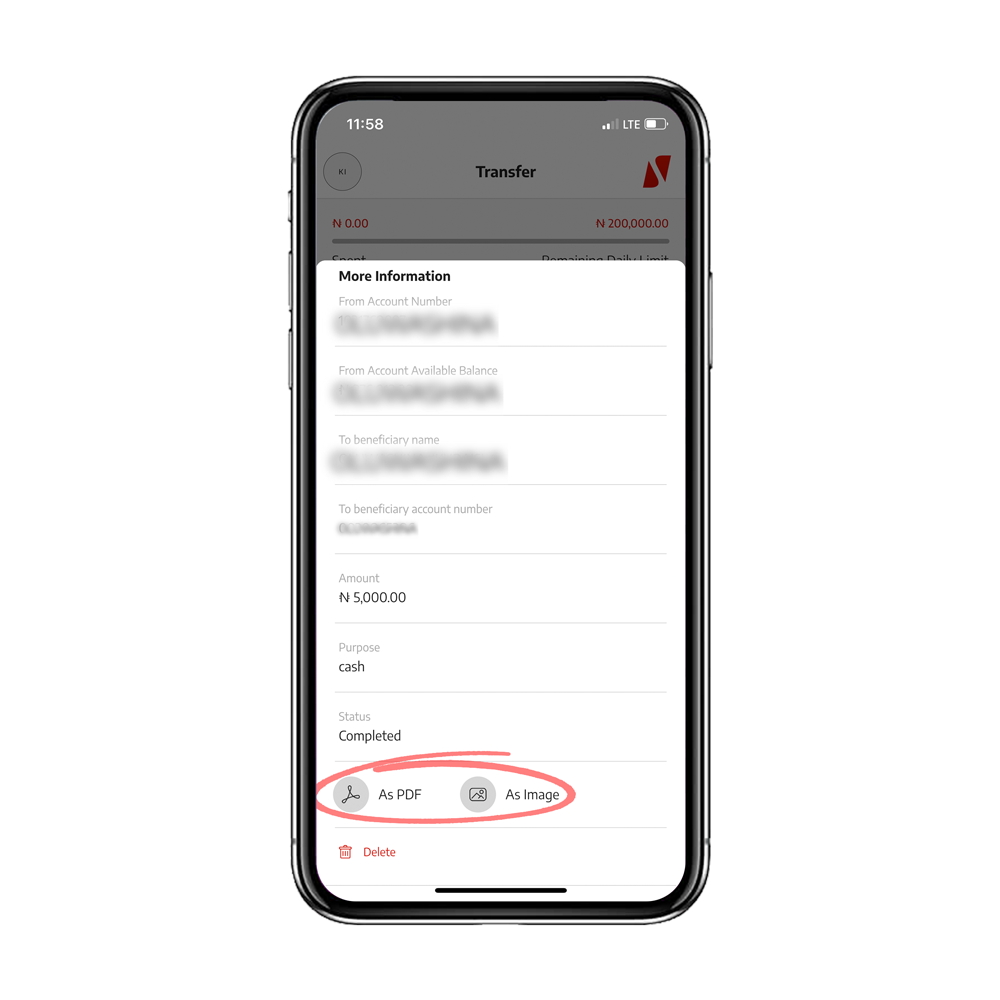

Download different formats on transaction receipt

You can download your transaction receipts in Jpeg or pdf format.

Benefits.

Convenience

Same login, any device. Access the new Digital Experience on your tablet, laptop or desktop.

Flexibility

Whenever and wherever, you always have options. Access the new Digital Experience on any device. Sign up on the new UBA Mobile App and login with the same details on the new Internet banking.

FAQs

We are here to help

- Migration

- Others

Migration

Yes. All users on the new platform will be subject to a default limit of ₦200,000.00. They can however increase their limits via self-service with their securepass.

When you change your device, you may be prompted to authenticate on the new device, simply proceed with the instructions.

Note: You will be able to add your profile on up to 2 devices for flexibility. You may also delete devices from the “Manage devices and sessions” tab under the settings

Others

In addition to the features you enjoyed on the old app, you can now enjoy features like personal financial management(budgeting & savings goal), rename account, modify language, set low balance alert, inbox messaging, view total and individual balance, Currency converter and others.

You can reset your PIN by clicking on Forgot Transaction PIN under More ->settings(after login).

You can change your PIN by clicking on Modify Transaction PIN under More -> settings (after login)

You can download UBA securepass from Google playstore or Apple Store. Please note that you may need to visit a business office or call CFC if you get a prompt stating “user is not eligible for one-time password”

After you log in to the app, proceed to Request bank Statement under More -> Products & Services to send your statement to your email, a financial institution or an embassy.

The default limit is ₦200,000.00 with PIN and 1m with secure pass. To increase your limit up to ₦5 million, you have to fulfill the e-indemnity on the app.

Kindly click on more in the account container and select the account you wish to view. Then you can click on the reference transaction with options to download as pdf or image and an option to dispute the transaction. You can also tag the transaction or put it in a category for easy tracking.

You will need to upgrade your profile with your card details or securepass. Kindly proceed to “My profile” by clicking on the More container to upgrade your profile.

As much we want you to see your goals through to the end, you have the option to stop the savings goal and recover your money before the due date. Simply click on the goal and click on the settings icon to edit or delete your savings goal.

You can customize your dashboard, change the theme of the app, set savings goals, open a new account, wave to hide your balance etc.

Thank you for your interest in UBA and our Mobile App. Please visit the Apps stores to rate the App (we expect to have your 5 *****) and state your review to encourage others to also download the app and enjoy its awesomeness.