How to choose the best digital banking platform

An Expert Guide: How to Choose the Best Digital Banking Platform

Home » Digital banking solutions » How to choose the best digital banking platform

There are so many banking platforms, which do I choose? This is a question many ask. We know this because you clicked the link to an article called ‘how to choose the best digital Banking platform’.

What is a digital banking platform?

It is simply an opportunity that allows us create a unified, flawless, personalized, engaging, multi-channel banking experience for you, our customer.

There are several digital banking platforms but what makes any the ‘best’ is how well it suits your needs and is able to adapt to your lifestyle.

UBA offers a host of digital financial products that enhance customers’ experience across all channels.

UBA Internet Banking

Through UBA Internet Banking, you can securely perform such basic banking transactions as

- – Buying airtime

- – Transferring money

- – Paying bills

- – in addition to features such as instant self-registration

- – image & phrase security

- – multiple payments on the screen

- – creating payment templates

- – sending funds to a branch for pick up by third party

- – booking flights and much more.

With UBA Internet Banking you can conduct financial transactions through any internet-enabled devices such as computer, laptop, smart phone via https://ibank.ubagroup.com

How to Register/Enrol on UBA Internet Banking

- Instant Self-Registration – Enrolment on the internet banking platform just got easier with your debit card. Individual customers can start the process of enrolment from the Internet Banking login page https://ibank.ubagroup.com by clicking the Instant Self-Registration button. It only takes a few minutes to complete the process.

- Enrolment via Account Opening – Customers can be enrolled instantly on Internet Banking during the account opening process.

- Enrolment via UBA Business Office – New & existing customers can walk into any of the Business Offices to fill a form to be enrolled on the Internet Banking channel. Corporate customers can also give instruction to have their desired users enrolled, multiple users can be enrolled under a corporate user.

Mobile banking

This is the use of smartphones or other cellular devices to perform online banking tasks on the go, such as checking your account balance, transferring money, paying bills and locating an ATM.

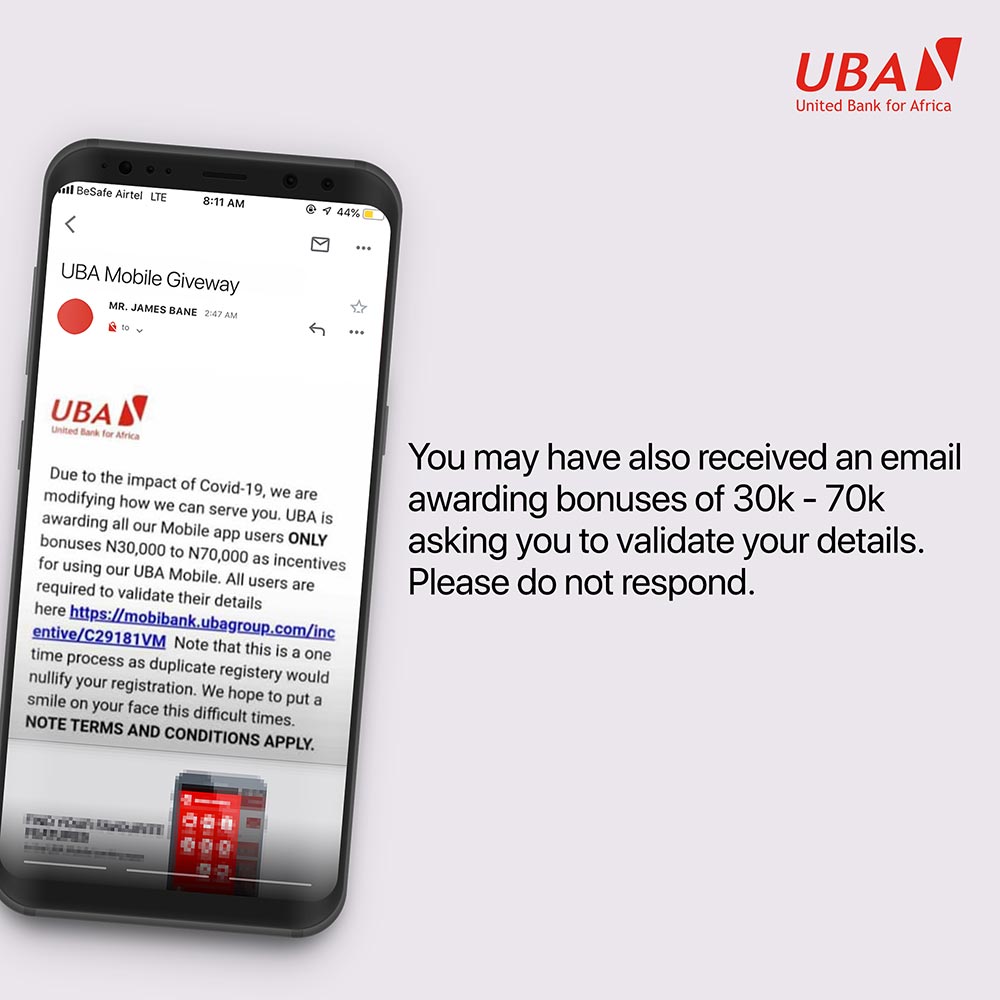

On the UBA Mobile App, you can recharge your data subscription, make airtime & bill payments, make cardless withdrawals and instant cash transfers anywhere, anytime, have access to 24-hour customer service support via live chat etc.UBA mobile banking gives you unrestricted and secure access to your account, anytime, anywhere with or without the Internet.

How to Register for UBA Mobile Banking app

- UBA Debit Card

- UBA Prepaid Card

- UBA Account + Secure Pass

What is Referral id in UBA Mobile Banking?

The referral code is the ID of the staff who referred the account to you. You can skip this step if you do not have or remember their id as it is optional

Magic Banking

Using the USSD Magic Banking code *919#, you can open an account, transfer funds, buy airtime and pay for your flight all without Internet access.

Even when you are on the go or have access to the Internet, with the *919# Magic Banking seamless interface and features you can have your banking needs treated with ease.

How to Sign Up/ Register for UBA Magic Banking

To register for UBA Magic Banking, there are two registration options. To begin dial *919# to see the “Main Menu” and select your desired option. If the user is unregistered, she/he would be prompted to register with these options:

- With UBA Account

- With UBA Prepaid Card

How to Get Secure Pass for UBA Magic Banking

This is a digital token available on iOS and Android store. It can be used to increase transaction limit on 919 Magic Banking

What is Referral id in UBA Magic Banking?

The referral code is the ID of the staff who referred the account to you. You can skip this step if you do not have or remember their id as it is optional

POS

Payment options such as POS or QR Codes exist for business owners who need a digital option.

The Point of Sale (POS) terminal facilitates payments for goods and services at merchant locations using payment cards issued by all banks.

POS terminals play a key role in the actualization of the cashless banking objectives as they become a more popular means of receiving payments and transacting business giving the business owner increased sales, more satisfied customers and increasing the speed of check out.

Business owners can also use Masterpass QR on Facebook Messenger to sign up their businesses to accept mobile payments using UBA’s Scan to Pay. Your customers will be able to pay by scanning the code from their smartphone or by entering your merchant ID into their feature phone.

Visit https://www.ubagroup.com/nigeria/personal-banking/digital-banking/ for more.

From individual with savings account to business owners and corporate account holders. There is a digital banking channel suited to everyone’s need. UBA’s range of retail e-products allows you to securely and conveniently access your bank account information and do banking transactions anywhere, anytime.