Effective Strategies for Saving Money

Home » Personal Banking » Accounts » Savings Account » Effective strategies for saving money

Earning money is difficult, I bet you’ll agree; understanding how money works can be even more so.

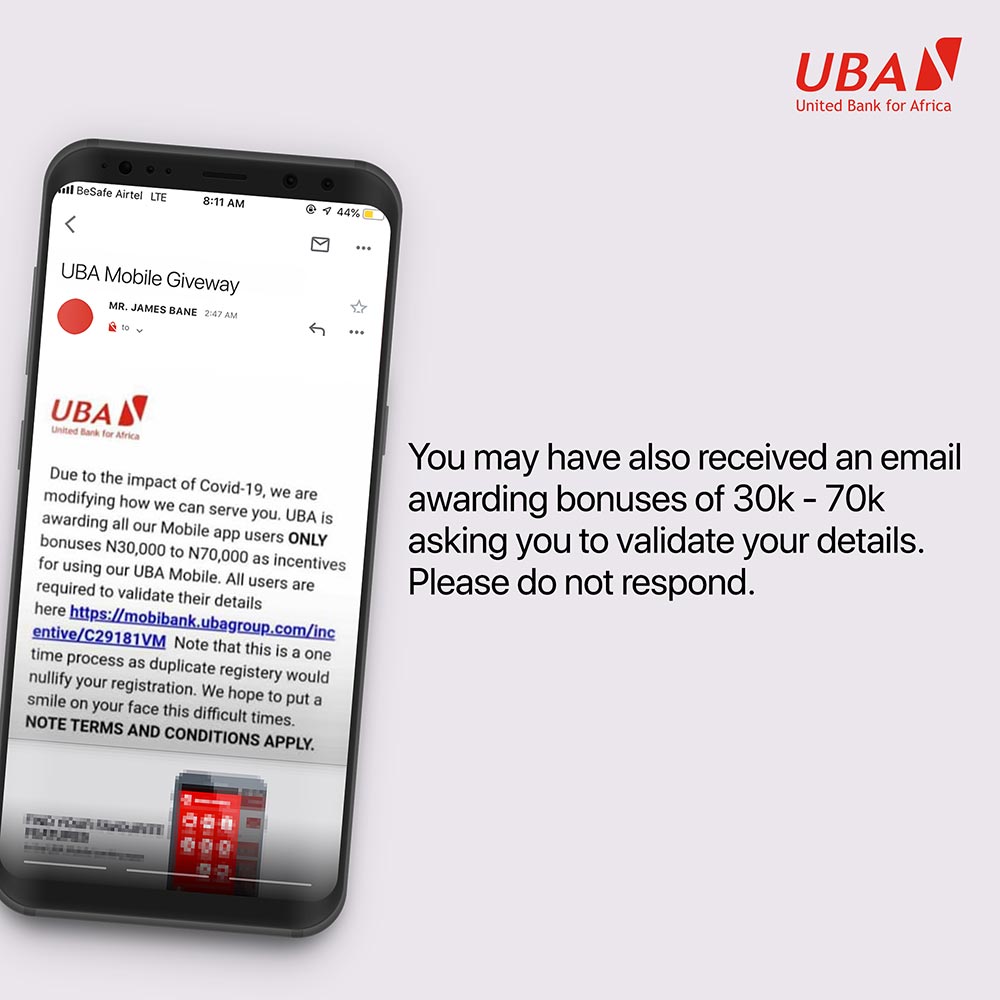

From dealing with the inflation of prices of goods and services during a pandemic, the fear of getting laid off or being put on compulsory leave, it is hard to save in these times, yet it is crucial if we’re to surmount to cycle of earning to eating.

There are several ways to reach your money goals and one of those is having the savings account suited to your growth needs. UBA as the best bank for saving offers different types of savings accounts that helps you save extensively while your interests grow.

Some the effective strategies to help you save better are as listed below:

Track spending effectively

To effectively save money you need to be able to accurately track your spending. With the UBA General Savings Account, you can track how much, when and where you spend using the Mobile Banking app linked to your account and enjoy amazing UBA Savings Account interest rate.

In addition to benefits such as being able to operate your account from anywhere in the world, you can also enjoy the flexibility of third-party cheque deposits and withdrawals on the account.

Set a target

In working to meet your money goals, you should have a target. When you have specified a realistic amount to save by a certain date, it gives you a sense of purpose and drive to achieve that goal. UBA Target Account is a savings account specifically designed for individuals to save towards a set goal or a project e.g. rent, further studies, etc.

UBA Target Savings Account offers you the convenience of saving and maximizing your investments, whilst having flexible access to your account at any time.

Adopt the 10% rule

A question that always arise is ‘how much should I save?’. When in doubt, it is safe to adopt the 10-percent rule, which is, save 10 percent of your earnings. “If you regularly save 10 percent of your income, no matter how much you earn, you will always have the confidence of knowing you are living within your means”.

Save smart with the UBA Bumper account

As a bonus saving incentive, UBA created the Bumper Account. This is an account that rewards you with prizes for saving a minimum of N5,000. Every month, 100 lucky customers win N100k each in the Bumper Monthly Draw, and you also stand a chance to win N2 million or N500,000 every quarter plus free shopping worth N100,000 for a year. This means that by saving at least N5,000 every month you may have even more money in your account. Dial *919*20# to open a Bumper Account instantly.

Having a savings culture requires practice but it is very rewarding. Visit https://www.ubagroup.com/nigeria/personal-banking/accounts/savings-accounts/ to start the journey to reach your money goals.

What are the benefits of Opening a UBA Savings Account?

Will you like to start saving towards your goals while enjoying mouth-watering benefits? All you need to do is open any of the savings account options by UBA. To help you start we have curated all the amazing benefits peculiar to each of the savings account below:

Benefits of Opening a General UBA Savings Account:

When you open a regular savings account with UBA,

- Flexible opening balance & attractive interest rates

- You enjoy access to the use of a UBA card on ATM, POS & Online anywhere in the world.

- You also enjoy access to our digital products & services 24hrs a day,

- Enjoy the flexibility of third-party cheque deposits and withdrawals on the account.

Benefit of Opening a Bumper Account:

Some of the benefit you can enjoy when you open a UBA Bumper Account include a chance to enjoy and win several exciting prizes like:

- N2 million or N500,000 every quarter

- Free shopping worth N100,000 for a year

- N100,000 every month

Benefit of Opening a UBA Target Account:

With UBA Target Account, you can enjoy flexible withdrawal anytime with accrued credit interest;

Credit interest is paid on a tiered basis on bands as highlighted below:

- N50,000-N99,999 = 75%

- N100,000-N999,999 = 3.80%

- N1million – N4,999,999 = 3.85%

- N5million and above = 4.00%

Open a UBA Savings Account Online Now

You can open a UBA bank account online with ease by using the Instant Account Opening platform or UBA Chat Banking – LEO on WhatsApp.

To open on the Instant Account Opening platform:

- With BVN

Click here to open a UBA Savings account instantly, if you have a BVN

- Without BVN

Start here to open a UBA Savings Account without BVN

To open a UBA bank account with UBA Chat Banking – LEO

Chat with Leo on FB messenger, WhatsApp or Apple Business Chat to open a UBA account anywhere, anytime.