Sustainable Banking

Our vision is to be the undisputed leading and dominant financial services institution in Africa.

At UBA we are convinced beyond doubt that integrating sustainable practices in our business is the right thing to do. It makes sense both as a business decision and from a corporate social responsibility perspective.

With our vision of being the leading and dominant financial service institution in Africa, we are committed to building a business that is sustainable and long lasting by maintaining the highest standard of governance in all our business activities and to our communities.

UBA understands its responsibilities are not only towards its customers and shareholders, but more importantly, to the communities in which we operate. This means continuously delivering value, managing our impact on society and providing innovative solutions in these communities.

As the Group MD/CEO says We believe that sustainability is the foundation of our long-term growth and profitability. Not only is it an integral part of our overall business strategy, it is also the right thing to do. It is the right thing for our customers, our suppliers, our shareholders our communities and for our staff as core members of The bank.

Corporate Social Responsibility

As Africa’s Global Bank, United Bank for Africa (UBA) is committed to the highest sustainability standards in our business practices and operations. We are at the forefront of consistently delivering sustainable financial services across all our countries of operation. The Bank fully understands the impact of local economic, social, and environmental factors on its operating environment. As part of our strategic intent, we commit 1% of the group’s annual profit to Corporate Social Responsibility (CSR) activities geared towards protecting the environment, promoting educational endeavours, fostering economic empowerment, as well as supporting other sustainable projects. UBA Foundation is committed to caring for the communities in which the bank operates.

With the widest financial service reach in Africa, UBA Foundation can leverage and facilitate philanthropic ventures unlike any other institution. UBA Foundation is actively involved in several initiatives and projects that not only bridge the literacy gap but also encourage economic and environmental sustainability.

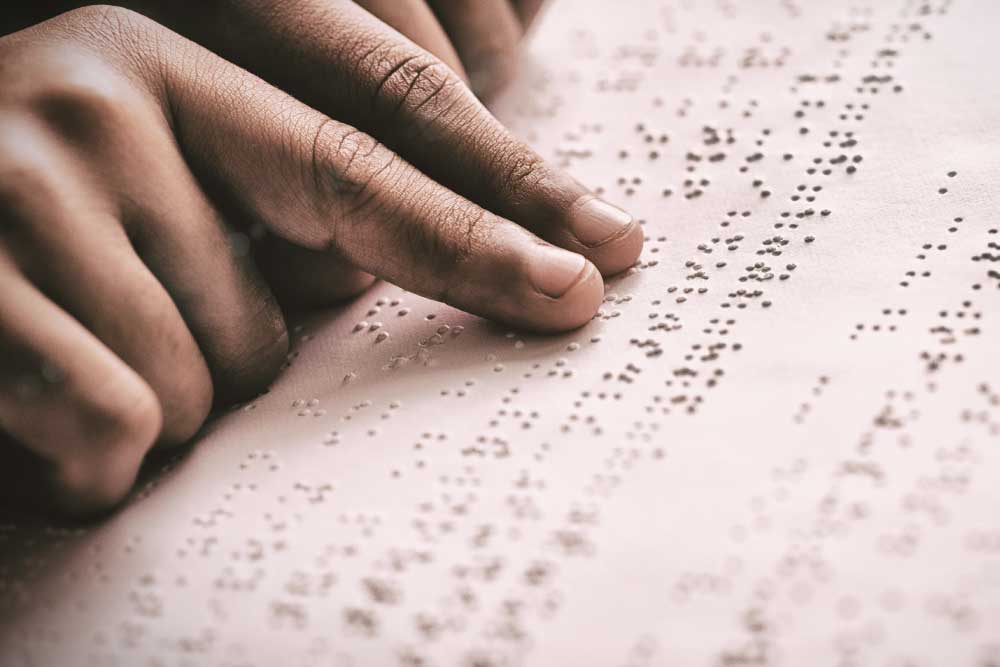

UBA Braille Account Opening Form

We are big on inclusion. This is why we have made our account opening process accessible to the visually impaired because we believe everyone deserves equal access to financial services. Discover a world of financial inclusion with us with the UBA Braille account form. The form offers convenient and accessible banking to the visually impaired.

FAQs

The Braille account opening form serves as a tool to assist visually impaired individuals in understanding and completing the standard account opening process. It is not an account itself but rather a form designed in Braille format to provide accessibility to visually impaired individuals.

- Visit any UBA (United Bank for Africa) branch.

- Request the Braille account opening form from a bank representative.

- The bank representative will provide you with the Braille account opening form.

- Read the Braille form carefully using your sense of touch.

- Fill in the required information by providing accurate and relevant details.

- If you need assistance in completing the form, you may request guidance from a bank representative or a trusted individual.

After completing the Braille account opening form, you will need to submit it to the bank for processing. Please hand in the completed form to a bank representative at any UBA branch along with any additional required documentation, such as identification cards or supporting materials.

While the availability of online or mail request options for the Braille account opening form may vary, it is recommended to visit a UBA branch in person to ensure prompt access to the form. This way, you can directly communicate with a bank representative who can assist you and provide the necessary guidance.

When completing the Braille account opening form, ensure that you provide accurate and up-to-date information as required by the bank. Pay attention to any specific instructions provided on the form and follow them accordingly. If you have any doubts or need assistance, do not hesitate to seek guidance from a bank representative.

Yes, it is permissible to have someone accompany you to assist in completing the Braille account opening form. This can be a trusted individual who can provide support in understanding the form’s content and completing the necessary sections accurately. However, it is important to ensure that your personal information remains confidential and is not shared with anyone unauthorised to access it.

The Braille account opening form can typically be used for various types of accounts offered by the bank, including savings accounts, current accounts, or other tier 3 account types specified by UBA. The form is designed to guide visually impaired individuals through the general account opening process, regardless of the specific account type being applied for.

Yes, if you require additional assistance or have specific accessibility needs during the Braille account opening process, it is recommended to inform the bank representative. UBA is committed to providing support and accommodations to ensure an inclusive and accessible banking experience for visually impaired individuals.

Generally, there are no charges associated with obtaining or submitting the Braille account opening form. However, it is advisable to inquire about any potential fees or charges specific to the services provided by UBA.

We are big on Corporate Governance

United Bank for Africa Plc (UBA Plc) holds good corporate governance as one of its core values and confirms its commitment to the implementation of effective corporate governance principles in its business operations, in line with the applicable Corporate Governance Codes.

In order to promote effective governance of the Bank, relevant structures have been put in place for the execution of the Bank’s Corporate Governance strategy, as elucidated in its Governance Charters, such as the Board, the Board Committees, and Executive Management Committees.

The Board of UBA Plc has also always places considerable emphasis on effective communication with its shareholders. The Bank ensures the protection of statutory and general rights of shareholders at all times, particularly their right to vote at General Meetings. All shareholders are treated equally regardless of their equity interest or social status.

Our Reports and Frameworks

- Sustainability Report 2023 - English

- Sustainability Report 2022 - English

- Sustainability Report 2022 - French

- Environmental & Social Management System

- Sustainable Finance Framework

- Sustainability Report 2021 - English

- Sustainability Report 2021 - French

- Sustainability Report 2021 - Portuguese

- Sustainability Report 2020

- Sustainability Report 2019